Key Points

- Buying the Dow Dogs doesn't mean it's time to sell the leaders.

- Letting winners run is an important factor in maximizing total returns.

- This year's winners could easily gain another double-digit amount in 2024.

- 5 stocks we like better than Apple

The Dogs of the Dow is a popular strategy getting much attention now that the year-end is here. The theory assumes that this year’s losers will be next year’s winners, which is often true. Dow Dogs offers value and above-average yield, with Walgreens Boots Alliance NASDAQ: WBA being a primary example. Walgreens is 2023’s worst-performing Dow stock, down 30% YOY but now trading at a deep value while paying more than 7% in yield. The value and yield alone are an attractive force, add in the new CEO, a potential sale of Boots and the outlook for turnaround, and it’s a viable if speculative investment for income seekers.

But should you sell this year’s Dow winners? Stocks like Salesforce.com NASDAQ: CRM and Intel NASDAQ: INTC are up 100% (or close enough) compared to last year, while others, like Microsoft NASDAQ: MSFT and Apple NASDAQ: AAPL, are up a solid 50%, offering attractive price points for profit-taking. Ultimately, aside from a little profit-taking, the answer is no. A general rule of thumb is to “let your profits run,” an adage that keeps traders and investors from selling out too early.

Salesforce.com has a triple tailwind; shares up 100% in 2023

Salesforce.com has a triple tailwind to drive business in 2024. The company is the leader in customer engagement, management and retention, expanding its business via new customers, deepening penetration of services and higher prices for subscriptions. That has the company on track to grow revenue by 11% and widen margins, with the top-line estimate likely low. Analysts have been upping their estimates for 2023 all year, and the consensus has yet to catch up with reality. Regarding the outlook for stock prices, Salesforce.com is the #3 Most Upgraded Stock on the Marketbeat.com platform for 2023, with recent upgrades suggesting another 35% upside for its price.

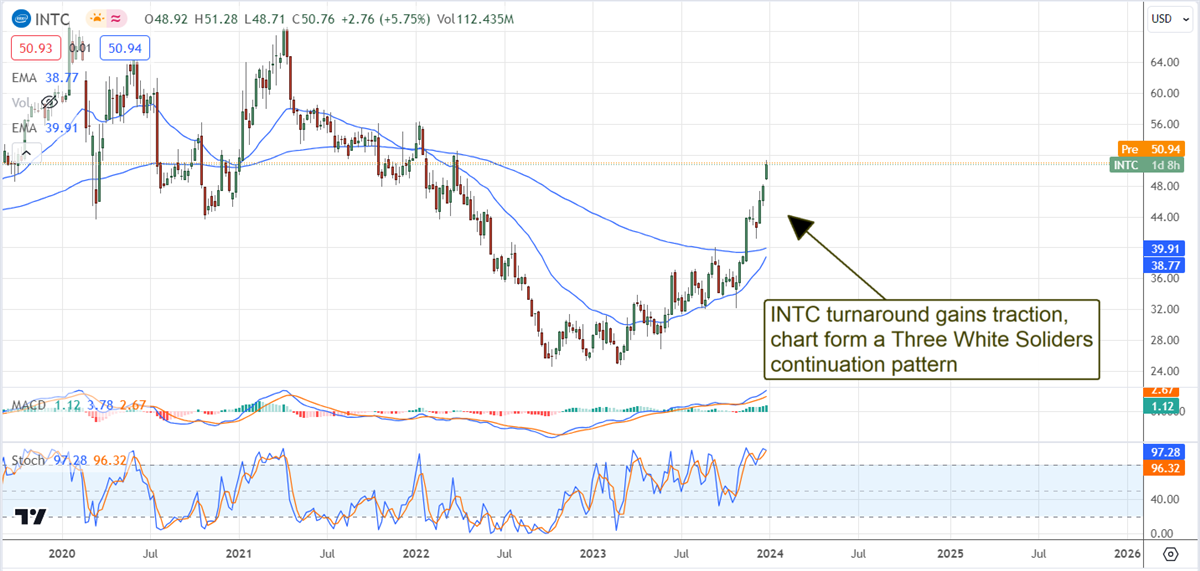

Intel turnaround gains momentum

Intel had a solid year, with turnaround efforts gaining traction. The company is set up to benefit from the PC market rebound, data center growth and AI in 2024 and could easily rise to its all-time high levels. This Hold-rated stock has seen a dramatic shift in analysts' sentiment, aiding the rebound in 2023. The analysts have issued numerous upgrades and price target increases, with sentiment up from Reduce and the price target up 13% over the past three months. Analysts expect revenue to grow by 13% in F2024 and earnings to more than double. The stock is overvalued at $50.76 relative to the consensus estimate, but recent targets are all well above that level and imply 1000 bps of upside.

Microsoft: a distant 3rd with a solid 56% gain in 2023

Microsoft is a distant 3rd with a YTD gain near 56% compared to Intel’s 90%+ but still up solidly and with an outlook for even higher prices. This is another Most Upgraded Stock for 2023, rated a Moderate Buy with a consensus price target leading the market, about 5% above the recent price action and up 30% compared to last year. The more recent targets suggest another 20% upside and higher targets are likely. The company is cemented as a go-to source for AI infrastructure, cloud and AI-powered cloud services, so it is likely to exceed the already robust estimates for 2024. The analysts forecast 14% revenue growth in F2024 and 2025 with margin expansion.

Apple will return to growth in 2024

Apple is up about 50% in calendar 2023 despite sluggish sales and mixed results and will likely move higher in 2024. The company is expected to return to growth this year and widen its margin with sustained improvement in top and bottom-line results in F2025. Analysts' activity is also mixed but favorable to higher share prices. The analysts have adjusted sentiment and price targets up and down over the past year, but the net result is largely unchanged. The 35 analysts tracked by Marketbeat rate the stock as a Moderate Buy with a consensus target aligning with the all-time high. The high target is 25% above that.

Before you consider Apple, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Apple wasn't on the list.

While Apple currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of the 10 best stocks to own in 2024 and why they should be in your portfolio.

Get This Free Report