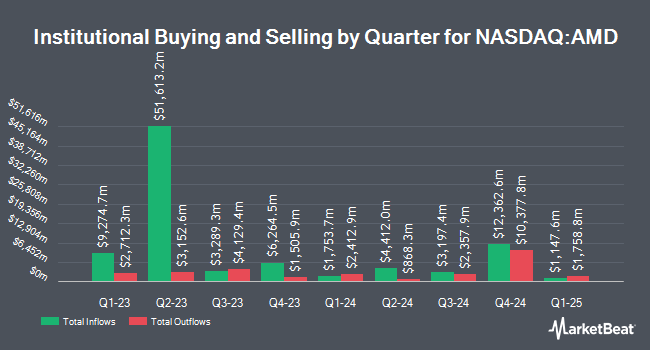

Picton Mahoney Asset Management cut its stake in Advanced Micro Devices, Inc. (NASDAQ:AMD - Free Report) by 45.8% during the fourth quarter, according to its most recent 13F filing with the Securities and Exchange Commission. The institutional investor owned 121,232 shares of the semiconductor manufacturer's stock after selling 102,514 shares during the quarter. Advanced Micro Devices makes up approximately 0.5% of Picton Mahoney Asset Management's portfolio, making the stock its 27th largest holding. Picton Mahoney Asset Management's holdings in Advanced Micro Devices were worth $17,869,000 at the end of the most recent reporting period.

Other institutional investors also recently bought and sold shares of the company. Peoples Bank KS acquired a new position in Advanced Micro Devices during the third quarter worth about $26,000. Spartan Planning & Wealth Management acquired a new position in shares of Advanced Micro Devices during the 3rd quarter worth approximately $27,000. Bare Financial Services Inc acquired a new position in shares of Advanced Micro Devices during the 4th quarter worth approximately $29,000. MeadowBrook Investment Advisors LLC purchased a new stake in shares of Advanced Micro Devices in the fourth quarter valued at approximately $29,000. Finally, Gables Capital Management Inc. acquired a new stake in shares of Advanced Micro Devices in the fourth quarter valued at approximately $29,000. 71.34% of the stock is currently owned by institutional investors and hedge funds.

Advanced Micro Devices Stock Performance

Advanced Micro Devices stock traded down $1.35 during midday trading on Tuesday, hitting $154.43. 37,302,953 shares of the company's stock were exchanged, compared to its average volume of 71,253,945. The firm's 50 day simple moving average is $174.53 and its 200 day simple moving average is $153.23. Advanced Micro Devices, Inc. has a 12-month low of $89.17 and a 12-month high of $227.30. The company has a debt-to-equity ratio of 0.03, a quick ratio of 1.92 and a current ratio of 2.64. The stock has a market cap of $249.61 billion, a price-to-earnings ratio of 227.11, a price-to-earnings-growth ratio of 2.33 and a beta of 1.66.

Advanced Micro Devices (NASDAQ:AMD - Get Free Report) last announced its earnings results on Tuesday, April 30th. The semiconductor manufacturer reported $0.62 earnings per share for the quarter, beating the consensus estimate of $0.61 by $0.01. Advanced Micro Devices had a return on equity of 5.72% and a net margin of 4.89%. The company had revenue of $5.47 billion for the quarter, compared to the consensus estimate of $5.48 billion. During the same period last year, the business posted $0.43 EPS. The company's revenue was up 2.2% on a year-over-year basis. Equities research analysts predict that Advanced Micro Devices, Inc. will post 2.63 EPS for the current year.

Insider Activity at Advanced Micro Devices

In other news, CAO Darla M. Smith sold 1,678 shares of the firm's stock in a transaction that occurred on Thursday, February 29th. The stock was sold at an average price of $188.66, for a total value of $316,571.48. Following the completion of the sale, the chief accounting officer now directly owns 4,209 shares of the company's stock, valued at approximately $794,069.94. The transaction was disclosed in a legal filing with the Securities & Exchange Commission, which can be accessed through this link. In other news, CAO Darla M. Smith sold 1,678 shares of the stock in a transaction dated Thursday, February 29th. The shares were sold at an average price of $188.66, for a total value of $316,571.48. Following the completion of the transaction, the chief accounting officer now owns 4,209 shares in the company, valued at approximately $794,069.94. The sale was disclosed in a legal filing with the Securities & Exchange Commission, which is accessible through the SEC website. Also, Director Joseph A. Householder sold 6,572 shares of the business's stock in a transaction dated Monday, March 4th. The stock was sold at an average price of $208.08, for a total transaction of $1,367,501.76. Following the sale, the director now directly owns 2,197 shares in the company, valued at approximately $457,151.76. The disclosure for this sale can be found here. Insiders sold a total of 181,850 shares of company stock worth $34,637,833 over the last 90 days. Company insiders own 0.65% of the company's stock.

Wall Street Analysts Forecast Growth

Several equities analysts have weighed in on the stock. Cantor Fitzgerald decreased their target price on shares of Advanced Micro Devices from $190.00 to $170.00 and set an "overweight" rating on the stock in a report on Wednesday, May 1st. Evercore ISI lowered their price objective on Advanced Micro Devices from $200.00 to $193.00 and set an "outperform" rating for the company in a research report on Wednesday, May 1st. KeyCorp reduced their target price on Advanced Micro Devices from $270.00 to $230.00 and set an "overweight" rating on the stock in a research report on Wednesday, May 1st. StockNews.com cut Advanced Micro Devices from a "hold" rating to a "sell" rating in a report on Saturday. Finally, Melius raised Advanced Micro Devices from a "hold" rating to a "buy" rating in a research report on Monday, January 8th. One investment analyst has rated the stock with a sell rating, two have given a hold rating and twenty-seven have assigned a buy rating to the company's stock. Based on data from MarketBeat, Advanced Micro Devices has an average rating of "Moderate Buy" and a consensus price target of $183.94.

Get Our Latest Research Report on Advanced Micro Devices

About Advanced Micro Devices

(

Free Report)

Advanced Micro Devices, Inc operates as a semiconductor company worldwide. It operates through Data Center, Client, Gaming, and Embedded segments. The company offers x86 microprocessors and graphics processing units (GPUs) as an accelerated processing unit, chipsets, data center, and professional GPUs; and embedded processors, and semi-custom system-on-chip (SoC) products, microprocessor and SoC development services and technology, data processing unites, field programmable gate arrays (FPGA), and adaptive SoC products.

Featured Stories

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Advanced Micro Devices, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Advanced Micro Devices wasn't on the list.

While Advanced Micro Devices currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Just getting into the stock market? These 10 simple stocks can help beginning investors build long-term wealth without knowing options, technicals, or other advanced strategies.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.