New York State Common Retirement Fund reduced its stake in shares of Fastenal (NASDAQ:FAST - Free Report) by 4.5% during the 4th quarter, according to its most recent filing with the SEC. The firm owned 854,211 shares of the company's stock after selling 40,037 shares during the period. New York State Common Retirement Fund owned approximately 0.15% of Fastenal worth $55,327,000 at the end of the most recent quarter.

New York State Common Retirement Fund reduced its stake in shares of Fastenal (NASDAQ:FAST - Free Report) by 4.5% during the 4th quarter, according to its most recent filing with the SEC. The firm owned 854,211 shares of the company's stock after selling 40,037 shares during the period. New York State Common Retirement Fund owned approximately 0.15% of Fastenal worth $55,327,000 at the end of the most recent quarter.

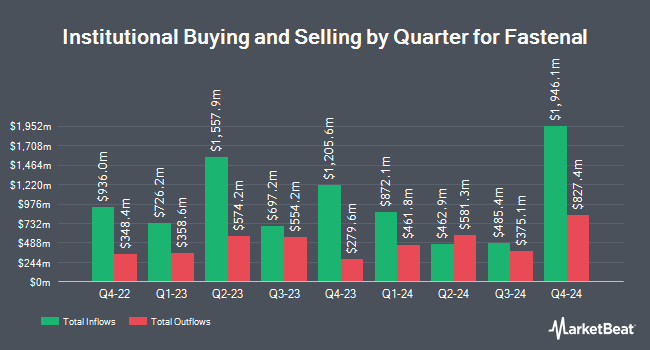

Several other hedge funds and other institutional investors also recently added to or reduced their stakes in FAST. Charles Schwab Investment Management Inc. grew its position in shares of Fastenal by 3.2% during the 3rd quarter. Charles Schwab Investment Management Inc. now owns 13,830,951 shares of the company's stock valued at $751,780,000 after acquiring an additional 423,112 shares during the period. Morgan Stanley grew its position in shares of Fastenal by 4.1% during the 3rd quarter. Morgan Stanley now owns 8,582,669 shares of the company's stock valued at $468,957,000 after acquiring an additional 337,168 shares during the period. Northern Trust Corp grew its position in shares of Fastenal by 5.9% during the 3rd quarter. Northern Trust Corp now owns 7,444,498 shares of the company's stock valued at $406,767,000 after acquiring an additional 413,572 shares during the period. Invesco Ltd. grew its position in shares of Fastenal by 16.5% during the 3rd quarter. Invesco Ltd. now owns 6,745,302 shares of the company's stock valued at $368,563,000 after acquiring an additional 957,091 shares during the period. Finally, Royal Bank of Canada grew its position in shares of Fastenal by 9.3% during the 3rd quarter. Royal Bank of Canada now owns 6,651,629 shares of the company's stock valued at $363,445,000 after acquiring an additional 568,372 shares during the period. 81.38% of the stock is owned by institutional investors and hedge funds.

Analysts Set New Price Targets

A number of equities research analysts have recently commented on the company. Loop Capital dropped their target price on Fastenal from $71.00 to $66.00 and set a "hold" rating on the stock in a research report on Monday, April 15th. Stifel Nicolaus raised their target price on Fastenal from $75.00 to $85.00 and gave the company a "buy" rating in a research report on Monday, March 18th. HSBC raised their target price on Fastenal from $59.00 to $64.00 and gave the company a "hold" rating in a research report on Monday, April 15th. Finally, Robert W. Baird dropped their target price on Fastenal from $77.00 to $71.00 and set a "neutral" rating on the stock in a research report on Friday, April 12th. Five investment analysts have rated the stock with a hold rating and one has issued a buy rating to the company. Based on data from MarketBeat, the stock currently has a consensus rating of "Hold" and an average price target of $67.67.

View Our Latest Stock Report on Fastenal

Fastenal Price Performance

FAST stock traded up $0.23 during trading on Wednesday, hitting $67.74. The stock had a trading volume of 3,087,036 shares, compared to its average volume of 4,031,972. The company has a debt-to-equity ratio of 0.06, a current ratio of 4.83 and a quick ratio of 2.49. Fastenal has a twelve month low of $52.28 and a twelve month high of $79.04. The stock has a market capitalization of $38.78 billion, a P/E ratio of 33.53, a PEG ratio of 3.53 and a beta of 1.05. The company's 50-day moving average price is $73.54 and its two-hundred day moving average price is $66.63.

Fastenal (NASDAQ:FAST - Get Free Report) last posted its quarterly earnings data on Thursday, April 11th. The company reported $0.52 earnings per share (EPS) for the quarter, missing the consensus estimate of $0.53 by ($0.01). Fastenal had a return on equity of 33.98% and a net margin of 15.68%. The firm had revenue of $1.90 billion during the quarter, compared to analyst estimates of $1.91 billion. During the same quarter in the previous year, the firm posted $0.52 earnings per share. The company's quarterly revenue was up 1.9% on a year-over-year basis. As a group, research analysts predict that Fastenal will post 2.12 EPS for the current fiscal year.

Fastenal Announces Dividend

The firm also recently announced a quarterly dividend, which will be paid on Thursday, May 23rd. Shareholders of record on Thursday, April 25th will be paid a $0.39 dividend. This represents a $1.56 dividend on an annualized basis and a yield of 2.30%. The ex-dividend date of this dividend is Wednesday, April 24th. Fastenal's dividend payout ratio (DPR) is 77.23%.

Insiders Place Their Bets

In other news, VP Charles S. Miller sold 11,076 shares of Fastenal stock in a transaction that occurred on Friday, March 15th. The shares were sold at an average price of $75.16, for a total transaction of $832,472.16. The transaction was disclosed in a document filed with the SEC, which is accessible through this hyperlink. In other news, VP Charles S. Miller sold 11,076 shares of Fastenal stock in a transaction that occurred on Friday, March 15th. The shares were sold at an average price of $75.16, for a total transaction of $832,472.16. The transaction was disclosed in a document filed with the SEC, which is accessible through this hyperlink. Also, insider William Joseph Drazkowski sold 11,968 shares of the business's stock in a transaction that occurred on Thursday, January 25th. The shares were sold at an average price of $69.10, for a total value of $826,988.80. Following the completion of the sale, the insider now directly owns 5,997 shares in the company, valued at approximately $414,392.70. The disclosure for this sale can be found here. Insiders have sold 48,050 shares of company stock valued at $3,411,049 in the last ninety days. 0.41% of the stock is currently owned by corporate insiders.

Fastenal Profile

(

Free Report)

Fastenal Company, together with its subsidiaries, engages in the wholesale distribution of industrial and construction supplies in the United States, Canada, Mexico, North America, and internationally. It offers fasteners, and related industrial and construction supplies under the Fastenal name. The company's fastener products include threaded fasteners, bolts, nuts, screws, studs, and related washers that are used in manufactured products and construction projects, as well as in the maintenance and repair of machines.

Featured Stories

Before you consider Fastenal, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Fastenal wasn't on the list.

While Fastenal currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Thinking about investing in Meta, Roblox, or Unity? Click the link to learn what streetwise investors need to know about the metaverse and public markets before making an investment.

Get This Free Report