Funko, Inc. (NASDAQ:FNKO - Get Free Report) insider Andrew David Oddie sold 2,353 shares of the stock in a transaction that occurred on Monday, April 22nd. The shares were sold at an average price of $6.21, for a total transaction of $14,612.13. Following the sale, the insider now owns 60,476 shares in the company, valued at approximately $375,555.96. The transaction was disclosed in a filing with the Securities & Exchange Commission, which can be accessed through this hyperlink.

Funko, Inc. (NASDAQ:FNKO - Get Free Report) insider Andrew David Oddie sold 2,353 shares of the stock in a transaction that occurred on Monday, April 22nd. The shares were sold at an average price of $6.21, for a total transaction of $14,612.13. Following the sale, the insider now owns 60,476 shares in the company, valued at approximately $375,555.96. The transaction was disclosed in a filing with the Securities & Exchange Commission, which can be accessed through this hyperlink.

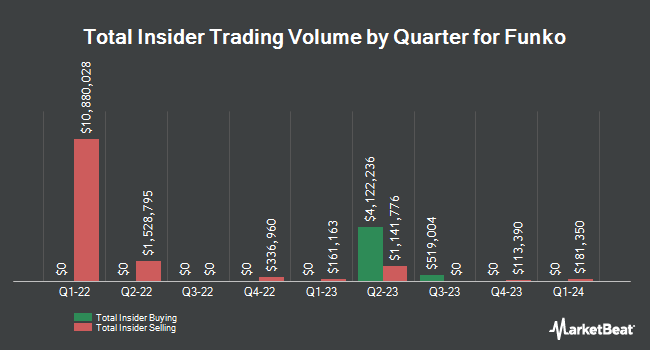

Andrew David Oddie also recently made the following trade(s):

- On Monday, March 11th, Andrew David Oddie sold 2,337 shares of Funko stock. The shares were sold at an average price of $6.62, for a total transaction of $15,470.94.

- On Thursday, March 7th, Andrew David Oddie sold 3,422 shares of Funko stock. The stock was sold at an average price of $6.41, for a total transaction of $21,935.02.

Funko Price Performance

Shares of Funko stock traded down $0.07 during trading hours on Tuesday, reaching $6.11. 651,501 shares of the company's stock were exchanged, compared to its average volume of 455,490. Funko, Inc. has a 1 year low of $5.27 and a 1 year high of $13.42. The company has a market capitalization of $324.26 million, a P/E ratio of -1.94 and a beta of 1.04. The business has a fifty day moving average of $6.44 and a two-hundred day moving average of $6.98. The company has a quick ratio of 0.62, a current ratio of 0.96 and a debt-to-equity ratio of 0.55.

Funko (NASDAQ:FNKO - Get Free Report) last announced its earnings results on Thursday, March 7th. The company reported ($0.05) earnings per share for the quarter, hitting the consensus estimate of ($0.05). The company had revenue of $291.24 million during the quarter, compared to analyst estimates of $284.90 million. Funko had a negative net margin of 14.06% and a negative return on equity of 20.78%. As a group, research analysts predict that Funko, Inc. will post -0.34 earnings per share for the current fiscal year.

Hedge Funds Weigh In On Funko

Hedge funds have recently modified their holdings of the business. Principal Financial Group Inc. lifted its holdings in Funko by 6.2% in the third quarter. Principal Financial Group Inc. now owns 40,578 shares of the company's stock valued at $310,000 after acquiring an additional 2,384 shares during the period. Strs Ohio purchased a new stake in shares of Funko during the 3rd quarter worth about $25,000. Quarry LP purchased a new stake in shares of Funko during the 4th quarter worth about $34,000. Tower Research Capital LLC TRC boosted its holdings in Funko by 145.1% in the 4th quarter. Tower Research Capital LLC TRC now owns 8,210 shares of the company's stock worth $63,000 after acquiring an additional 4,861 shares during the period. Finally, RPO LLC purchased a new position in Funko in the 4th quarter worth approximately $86,000. 99.15% of the stock is currently owned by hedge funds and other institutional investors.

Wall Street Analysts Forecast Growth

Separately, B. Riley began coverage on shares of Funko in a research report on Wednesday, April 10th. They set a "buy" rating and a $10.00 price objective on the stock. One research analyst has rated the stock with a sell rating, two have assigned a hold rating and two have given a buy rating to the company's stock. Based on data from MarketBeat, Funko currently has a consensus rating of "Hold" and an average target price of $8.92.

View Our Latest Analysis on FNKO

About Funko

(

Get Free Report)

Funko, Inc, a pop culture consumer products company, designs, sources, and distributes licensed pop culture products in the United States, Europe, and internationally. The company provides media and entertainment content, including movies, television (TV) shows, video games, music, and sports; figures, handbags, backpacks, wallets, apparel, accessories, plush products, homewares, and digital non-fungible tokens; and art prints and vinyl records, posters, soundtracks, toys, books, games, and other collectibles.

Featured Stories

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Funko, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Funko wasn't on the list.

While Funko currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are likely to thrive in today's challenging market? Click the link below and we'll send you MarketBeat's list of ten stocks that will drive in any economic environment.

Get This Free Report