Shah Capital Management boosted its position in Novavax, Inc. (NASDAQ:NVAX - Free Report) by 22.9% in the 4th quarter, according to its most recent filing with the Securities and Exchange Commission (SEC). The institutional investor owned 7,780,756 shares of the biopharmaceutical company's stock after purchasing an additional 1,450,000 shares during the period. Novavax comprises 9.6% of Shah Capital Management's investment portfolio, making the stock its 4th biggest position. Shah Capital Management owned approximately 6.55% of Novavax worth $37,348,000 at the end of the most recent reporting period.

Shah Capital Management boosted its position in Novavax, Inc. (NASDAQ:NVAX - Free Report) by 22.9% in the 4th quarter, according to its most recent filing with the Securities and Exchange Commission (SEC). The institutional investor owned 7,780,756 shares of the biopharmaceutical company's stock after purchasing an additional 1,450,000 shares during the period. Novavax comprises 9.6% of Shah Capital Management's investment portfolio, making the stock its 4th biggest position. Shah Capital Management owned approximately 6.55% of Novavax worth $37,348,000 at the end of the most recent reporting period.

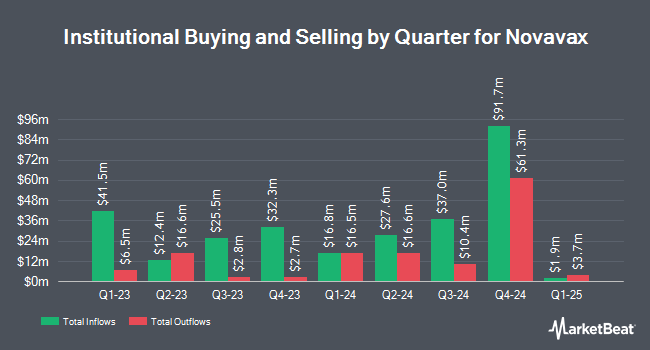

Other hedge funds have also recently bought and sold shares of the company. Vanguard Group Inc. grew its holdings in Novavax by 9.3% during the 3rd quarter. Vanguard Group Inc. now owns 11,551,476 shares of the biopharmaceutical company's stock valued at $83,633,000 after buying an additional 978,873 shares during the last quarter. TSP Capital Management Group LLC boosted its holdings in shares of Novavax by 162.8% during the third quarter. TSP Capital Management Group LLC now owns 966,350 shares of the biopharmaceutical company's stock worth $6,996,000 after purchasing an additional 598,600 shares during the last quarter. Federated Hermes Inc. boosted its holdings in shares of Novavax by 108.7% during the third quarter. Federated Hermes Inc. now owns 461,827 shares of the biopharmaceutical company's stock worth $3,344,000 after purchasing an additional 240,514 shares during the last quarter. SG Americas Securities LLC acquired a new stake in shares of Novavax during the fourth quarter worth $824,000. Finally, Raymond James & Associates acquired a new stake in shares of Novavax during the third quarter worth $1,021,000. 53.04% of the stock is owned by hedge funds and other institutional investors.

Wall Street Analysts Forecast Growth

Separately, HC Wainwright reduced their target price on Novavax from $35.00 to $19.00 and set a "buy" rating on the stock in a report on Friday, March 1st.

Check Out Our Latest Report on NVAX

Novavax Stock Up 4.9 %

Shares of Novavax stock traded up $0.20 on Monday, hitting $4.29. 3,888,365 shares of the company traded hands, compared to its average volume of 7,346,505. The company has a 50-day moving average price of $4.70 and a 200 day moving average price of $5.09. Novavax, Inc. has a 12-month low of $3.53 and a 12-month high of $11.36. The company has a market cap of $600.39 million, a PE ratio of -0.78 and a beta of 1.59.

Novavax (NASDAQ:NVAX - Get Free Report) last issued its quarterly earnings data on Wednesday, February 28th. The biopharmaceutical company reported ($1.44) earnings per share (EPS) for the quarter, missing analysts' consensus estimates of ($0.49) by ($0.95). The company had revenue of $291.34 million for the quarter, compared to analysts' expectations of $310.96 million. The company's quarterly revenue was down 18.5% compared to the same quarter last year. During the same period in the previous year, the company earned ($2.28) EPS. Equities research analysts anticipate that Novavax, Inc. will post -0.83 EPS for the current year.

Novavax Profile

(

Free Report)

Novavax, Inc, a biotechnology company, that promotes improved health by discovering, developing, and commercializing vaccines to protect against serious infectious diseases. It offers vaccine platform that combines a recombinant protein approach, nanoparticle technology, and its patented Matrix-M adjuvant to enhance the immune response.

Recommended Stories

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Novavax, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Novavax wasn't on the list.

While Novavax currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of the 10 best stocks to own in 2024 and why they should be in your portfolio.

Get This Free Report