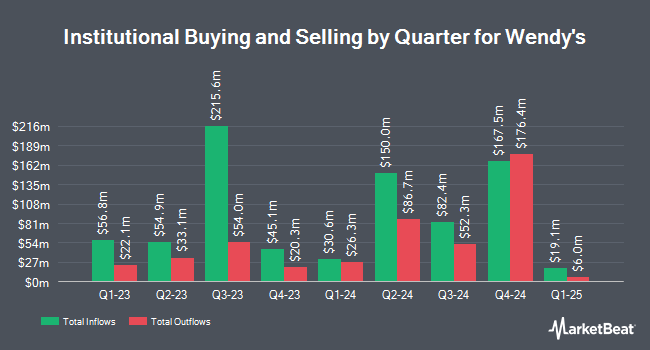

Quest Partners LLC bought a new position in shares of The Wendy's Company (NASDAQ:WEN - Free Report) during the fourth quarter, according to the company in its most recent 13F filing with the Securities and Exchange Commission. The firm bought 55,302 shares of the restaurant operator's stock, valued at approximately $1,077,000.

Several other large investors have also added to or reduced their stakes in WEN. Trian Fund Management L.P. grew its holdings in Wendy's by 60.9% during the 3rd quarter. Trian Fund Management L.P. now owns 33,350,743 shares of the restaurant operator's stock valued at $680,689,000 after buying an additional 12,618,115 shares in the last quarter. Norges Bank bought a new stake in Wendy's in the 4th quarter valued at $27,627,000. Vanguard Group Inc. lifted its stake in Wendy's by 6.1% in the 3rd quarter. Vanguard Group Inc. now owns 20,248,412 shares of the restaurant operator's stock worth $413,270,000 after purchasing an additional 1,162,540 shares in the last quarter. AQR Capital Management LLC boosted its holdings in shares of Wendy's by 193.7% during the 3rd quarter. AQR Capital Management LLC now owns 1,277,958 shares of the restaurant operator's stock valued at $26,083,000 after purchasing an additional 842,856 shares during the last quarter. Finally, Savoir Faire Capital Management L.P. purchased a new position in shares of Wendy's during the third quarter valued at about $4,297,000. Hedge funds and other institutional investors own 85.96% of the company's stock.

Analysts Set New Price Targets

A number of equities analysts recently commented on the company. TD Cowen reissued a "hold" rating and set a $19.00 price target on shares of Wendy's in a research note on Friday, May 3rd. Citigroup raised their target price on shares of Wendy's from $20.00 to $21.00 and gave the company a "neutral" rating in a report on Friday, May 3rd. Piper Sandler upped their price target on shares of Wendy's from $21.00 to $23.00 and gave the company an "overweight" rating in a research note on Friday, May 3rd. BMO Capital Markets lifted their price objective on shares of Wendy's from $20.00 to $22.00 and gave the stock a "market perform" rating in a research note on Friday, May 3rd. Finally, Truist Financial decreased their target price on shares of Wendy's from $23.00 to $22.00 and set a "buy" rating on the stock in a research report on Tuesday, February 20th. Fourteen investment analysts have rated the stock with a hold rating and three have issued a buy rating to the stock. Based on data from MarketBeat.com, Wendy's currently has a consensus rating of "Hold" and an average target price of $22.06.

Read Our Latest Stock Analysis on Wendy's

Insiders Place Their Bets

In other news, Director Kenneth W. Gilbert sold 4,500 shares of the firm's stock in a transaction dated Friday, March 1st. The shares were sold at an average price of $18.07, for a total value of $81,315.00. Following the sale, the director now directly owns 31,304 shares in the company, valued at approximately $565,663.28. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which can be accessed through this link. In related news, Director Kenneth W. Gilbert sold 4,500 shares of the company's stock in a transaction dated Friday, March 1st. The stock was sold at an average price of $18.07, for a total transaction of $81,315.00. Following the transaction, the director now directly owns 31,304 shares of the company's stock, valued at approximately $565,663.28. The sale was disclosed in a filing with the Securities & Exchange Commission, which is available at this link. Also, CMO Juan Carlos Loredo sold 44,806 shares of the firm's stock in a transaction dated Thursday, May 9th. The stock was sold at an average price of $19.50, for a total value of $873,717.00. Following the completion of the sale, the chief marketing officer now directly owns 27,586 shares of the company's stock, valued at approximately $537,927. The disclosure for this sale can be found here. 17.10% of the stock is currently owned by corporate insiders.

Wendy's Stock Down 1.4 %

NASDAQ:WEN traded down $0.25 during mid-day trading on Tuesday, reaching $17.84. The company's stock had a trading volume of 2,835,492 shares, compared to its average volume of 3,237,627. The company has a quick ratio of 2.02, a current ratio of 2.04 and a debt-to-equity ratio of 11.21. The Wendy's Company has a 1 year low of $17.64 and a 1 year high of $23.42. The stock has a fifty day moving average of $18.91 and a 200-day moving average of $19.03. The firm has a market capitalization of $3.66 billion, a PE ratio of 18.27, a price-to-earnings-growth ratio of 1.81 and a beta of 0.78.

Wendy's (NASDAQ:WEN - Get Free Report) last released its quarterly earnings data on Thursday, May 2nd. The restaurant operator reported $0.23 earnings per share (EPS) for the quarter, beating analysts' consensus estimates of $0.21 by $0.02. The firm had revenue of $534.80 million for the quarter, compared to the consensus estimate of $540.84 million. Wendy's had a net margin of 9.44% and a return on equity of 62.68%. The company's quarterly revenue was up 1.1% on a year-over-year basis. During the same period last year, the firm earned $0.21 earnings per share. Equities research analysts forecast that The Wendy's Company will post 1 earnings per share for the current year.

Wendy's Dividend Announcement

The business also recently announced a quarterly dividend, which will be paid on Monday, June 17th. Shareholders of record on Monday, June 3rd will be paid a $0.25 dividend. The ex-dividend date is Monday, June 3rd. This represents a $1.00 annualized dividend and a yield of 5.61%. Wendy's's dividend payout ratio (DPR) is presently 101.01%.

Wendy's Profile

(

Free Report)

The Wendy's Company, together with its subsidiaries, operates as a quick-service restaurant company in the United States and internationally. It operates through Wendy's U.S., Wendy's International, and Global Real Estate & Development segments. The company is involved in operating, developing, and franchising a system of quick-service restaurants specializing in hamburger sandwiches.

Featured Articles

Before you consider Wendy's, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Wendy's wasn't on the list.

While Wendy's currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Just getting into the stock market? These 10 simple stocks can help beginning investors build long-term wealth without knowing options, technicals, or other advanced strategies.

Get This Free Report