Readystate Asset Management LP acquired a new position in B&G Foods, Inc. (NYSE:BGS - Free Report) in the fourth quarter, according to its most recent disclosure with the Securities & Exchange Commission. The institutional investor acquired 110,400 shares of the company's stock, valued at approximately $1,159,000. Readystate Asset Management LP owned 0.14% of B&G Foods at the end of the most recent reporting period.

Readystate Asset Management LP acquired a new position in B&G Foods, Inc. (NYSE:BGS - Free Report) in the fourth quarter, according to its most recent disclosure with the Securities & Exchange Commission. The institutional investor acquired 110,400 shares of the company's stock, valued at approximately $1,159,000. Readystate Asset Management LP owned 0.14% of B&G Foods at the end of the most recent reporting period.

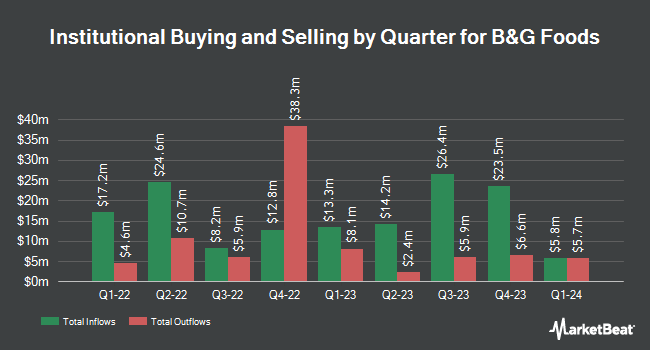

A number of other hedge funds also recently added to or reduced their stakes in the business. Rodgers Brothers Inc. lifted its stake in B&G Foods by 2.4% in the first quarter. Rodgers Brothers Inc. now owns 25,740 shares of the company's stock worth $694,000 after acquiring an additional 615 shares during the period. Guggenheim Capital LLC lifted its stake in B&G Foods by 3.6% in the second quarter. Guggenheim Capital LLC now owns 26,360 shares of the company's stock worth $367,000 after acquiring an additional 921 shares during the period. Captrust Financial Advisors lifted its position in shares of B&G Foods by 8.3% during the first quarter. Captrust Financial Advisors now owns 13,074 shares of the company's stock valued at $359,000 after buying an additional 998 shares during the last quarter. SummerHaven Investment Management LLC lifted its position in shares of B&G Foods by 1.9% during the fourth quarter. SummerHaven Investment Management LLC now owns 53,151 shares of the company's stock valued at $558,000 after buying an additional 1,007 shares during the last quarter. Finally, JPMorgan Chase & Co. lifted its position in shares of B&G Foods by 1.0% during the fourth quarter. JPMorgan Chase & Co. now owns 102,905 shares of the company's stock valued at $1,148,000 after buying an additional 1,013 shares during the last quarter. 66.15% of the stock is owned by hedge funds and other institutional investors.

B&G Foods Stock Down 0.4 %

Shares of BGS traded down $0.04 during mid-day trading on Thursday, hitting $10.58. 574,176 shares of the company traded hands, compared to its average volume of 1,022,010. B&G Foods, Inc. has a 1-year low of $7.20 and a 1-year high of $16.68. The company has a quick ratio of 0.89, a current ratio of 3.06 and a debt-to-equity ratio of 2.42. The company has a market capitalization of $835.95 million, a PE ratio of -12.02 and a beta of 0.71. The business has a 50 day moving average of $10.73 and a 200 day moving average of $9.98.

B&G Foods (NYSE:BGS - Get Free Report) last issued its quarterly earnings results on Tuesday, February 27th. The company reported $0.30 earnings per share for the quarter, topping the consensus estimate of $0.28 by $0.02. B&G Foods had a negative net margin of 3.21% and a positive return on equity of 8.68%. The company had revenue of $578.13 million for the quarter, compared to the consensus estimate of $569.65 million. During the same quarter in the prior year, the company earned $0.40 EPS. B&G Foods's quarterly revenue was down 7.2% on a year-over-year basis. Equities research analysts anticipate that B&G Foods, Inc. will post 0.83 EPS for the current year.

B&G Foods Dividend Announcement

The firm also recently declared a quarterly dividend, which will be paid on Tuesday, April 30th. Investors of record on Thursday, March 28th will be issued a $0.19 dividend. The ex-dividend date is Wednesday, March 27th. This represents a $0.76 annualized dividend and a yield of 7.19%. B&G Foods's dividend payout ratio (DPR) is presently -86.36%.

Analyst Ratings Changes

Several analysts have commented on the stock. Piper Sandler increased their price target on shares of B&G Foods from $8.00 to $9.00 and gave the company an "underweight" rating in a research report on Wednesday, February 28th. StockNews.com raised shares of B&G Foods from a "sell" rating to a "hold" rating in a research report on Saturday, March 9th. Two research analysts have rated the stock with a sell rating and two have issued a hold rating to the stock. Based on data from MarketBeat, the stock has a consensus rating of "Hold" and a consensus target price of $9.50.

Check Out Our Latest Stock Analysis on BGS

B&G Foods Profile

(

Free Report)

B&G Foods, Inc manufactures, sells, and distributes a portfolio of shelf-stable and frozen foods, and household products in the United States, Canada, and Puerto Rico. The company's products include frozen and canned vegetables, vegetables, canola and other cooking oils, vegetable shortening, cooking sprays, oatmeal and other hot cereals, fruit spreads, canned meats and beans, bagel chips, spices, seasonings, hot sauces, wine vinegar, maple syrups, molasses, salad dressings, pizza crusts, Mexican-style sauces, dry soups, taco shells and kits, salsas, pickles, peppers, tomato-based products, crackers, baking powder and soda, corn starch, nut clusters, and other specialty products.

See Also

Want to see what other hedge funds are holding BGS? Visit HoldingsChannel.com to get the latest 13F filings and insider trades for B&G Foods, Inc. (NYSE:BGS - Free Report).

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider B&G Foods, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and B&G Foods wasn't on the list.

While B&G Foods currently has a "Sell" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to generate income with your stock portfolio? Use these ten stocks to generate a safe and reliable source of investment income.

Get This Free Report