Bailard Inc. purchased a new stake in Fiserv, Inc. (NYSE:FI - Free Report) in the 4th quarter, according to its most recent filing with the Securities & Exchange Commission. The fund purchased 77,114 shares of the business services provider's stock, valued at approximately $10,244,000.

Bailard Inc. purchased a new stake in Fiserv, Inc. (NYSE:FI - Free Report) in the 4th quarter, according to its most recent filing with the Securities & Exchange Commission. The fund purchased 77,114 shares of the business services provider's stock, valued at approximately $10,244,000.

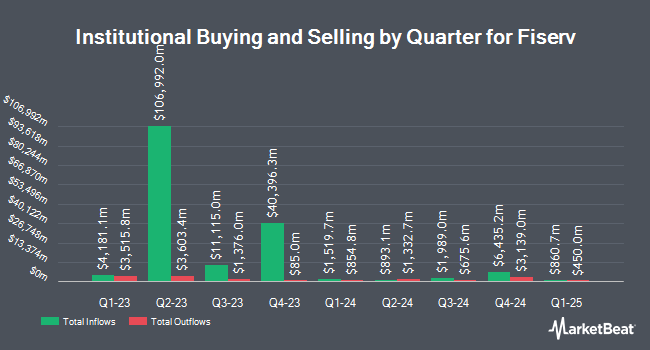

A number of other hedge funds and other institutional investors also recently made changes to their positions in FI. Hollencrest Capital Management raised its position in Fiserv by 75.8% during the third quarter. Hollencrest Capital Management now owns 232 shares of the business services provider's stock valued at $26,000 after purchasing an additional 100 shares in the last quarter. West Oak Capital LLC bought a new stake in Fiserv in the 4th quarter worth approximately $27,000. Halpern Financial Inc. purchased a new stake in Fiserv in the fourth quarter worth approximately $27,000. Fortitude Family Office LLC bought a new position in Fiserv during the fourth quarter valued at approximately $28,000. Finally, Glass Jacobson Investment Advisors llc purchased a new position in shares of Fiserv during the fourth quarter worth approximately $31,000. 90.98% of the stock is currently owned by institutional investors.

Analysts Set New Price Targets

A number of equities analysts recently commented on the stock. B. Riley lifted their target price on shares of Fiserv from $176.00 to $180.00 and gave the stock a "buy" rating in a research report on Wednesday. BNP Paribas raised Fiserv from a "neutral" rating to an "outperform" rating in a research note on Wednesday, January 10th. Truist Financial raised their price target on Fiserv from $140.00 to $145.00 and gave the stock a "hold" rating in a research report on Wednesday, February 7th. Stephens reiterated an "equal weight" rating and issued a $165.00 price objective on shares of Fiserv in a research report on Wednesday. Finally, Citigroup increased their price objective on Fiserv from $171.00 to $180.00 and gave the company a "buy" rating in a research note on Wednesday. Six research analysts have rated the stock with a hold rating and nineteen have given a buy rating to the stock. According to data from MarketBeat.com, Fiserv currently has a consensus rating of "Moderate Buy" and an average price target of $164.33.

Get Our Latest Research Report on FI

Insider Buying and Selling

In other Fiserv news, COO Guy Chiarello sold 24,000 shares of the business's stock in a transaction on Friday, March 15th. The shares were sold at an average price of $149.53, for a total transaction of $3,588,720.00. Following the completion of the sale, the chief operating officer now directly owns 163,699 shares in the company, valued at approximately $24,477,911.47. The sale was disclosed in a document filed with the SEC, which is available through this link. Over the last quarter, insiders have sold 111,575 shares of company stock worth $17,022,387. 0.75% of the stock is owned by insiders.

Fiserv Stock Performance

Shares of NYSE:FI traded down $3.14 during midday trading on Wednesday, reaching $152.25. 2,487,215 shares of the company's stock traded hands, compared to its average volume of 2,551,627. Fiserv, Inc. has a one year low of $109.11 and a one year high of $159.99. The stock has a 50 day moving average of $152.28 and a 200 day moving average of $137.34. The company has a market cap of $89.64 billion, a price-to-earnings ratio of 30.45, a P/E/G ratio of 1.22 and a beta of 0.91. The company has a debt-to-equity ratio of 0.73, a quick ratio of 1.04 and a current ratio of 1.04.

Fiserv (NYSE:FI - Get Free Report) last posted its earnings results on Tuesday, April 23rd. The business services provider reported $1.88 earnings per share (EPS) for the quarter, beating the consensus estimate of $1.77 by $0.11. Fiserv had a net margin of 16.07% and a return on equity of 15.16%. The business had revenue of $4.88 billion for the quarter, compared to analysts' expectations of $4.57 billion. During the same quarter in the prior year, the business earned $1.58 EPS. The business's revenue for the quarter was up 7.4% compared to the same quarter last year. As a group, equities research analysts anticipate that Fiserv, Inc. will post 8.63 EPS for the current fiscal year.

About Fiserv

(

Free Report)

Fiserv, Inc, together with its subsidiaries, provides payments and financial services technology services in the United States, Europe, the Middle East and Africa, Latin America, the Asia-Pacific, and internationally. It operates through Merchant Acceptance, Financial Technology, and Payments and Network segments.

Recommended Stories

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Fiserv, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Fiserv wasn't on the list.

While Fiserv currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

Get This Free Report