Truist Financial Corp lessened its stake in shares of Merck & Co., Inc. (NYSE:MRK - Free Report) by 7.1% in the 4th quarter, according to its most recent 13F filing with the Securities and Exchange Commission. The fund owned 3,771,324 shares of the company's stock after selling 289,465 shares during the quarter. Merck & Co., Inc. comprises about 0.7% of Truist Financial Corp's holdings, making the stock its 28th biggest holding. Truist Financial Corp owned 0.15% of Merck & Co., Inc. worth $411,150,000 as of its most recent filing with the Securities and Exchange Commission.

Truist Financial Corp lessened its stake in shares of Merck & Co., Inc. (NYSE:MRK - Free Report) by 7.1% in the 4th quarter, according to its most recent 13F filing with the Securities and Exchange Commission. The fund owned 3,771,324 shares of the company's stock after selling 289,465 shares during the quarter. Merck & Co., Inc. comprises about 0.7% of Truist Financial Corp's holdings, making the stock its 28th biggest holding. Truist Financial Corp owned 0.15% of Merck & Co., Inc. worth $411,150,000 as of its most recent filing with the Securities and Exchange Commission.

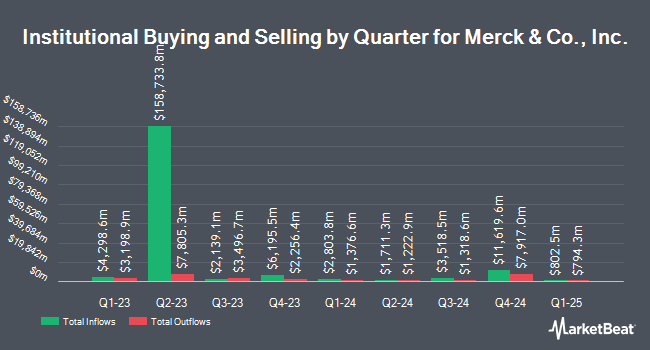

Several other large investors have also modified their holdings of MRK. Rakuten Securities Inc. acquired a new position in Merck & Co., Inc. during the fourth quarter worth approximately $30,000. RIA Advisory Group LLC acquired a new position in shares of Merck & Co., Inc. in the 4th quarter valued at $30,000. Ruedi Wealth Management Inc. raised its position in Merck & Co., Inc. by 180.2% in the 3rd quarter. Ruedi Wealth Management Inc. now owns 311 shares of the company's stock valued at $32,000 after purchasing an additional 200 shares during the last quarter. AlphaMark Advisors LLC acquired a new stake in Merck & Co., Inc. during the 4th quarter worth $34,000. Finally, Valued Wealth Advisors LLC purchased a new position in Merck & Co., Inc. during the 4th quarter worth $42,000. Institutional investors and hedge funds own 76.07% of the company's stock.

Insider Buying and Selling

In other Merck & Co., Inc. news, insider Joseph Romanelli sold 1,000 shares of the firm's stock in a transaction on Tuesday, February 13th. The stock was sold at an average price of $124.89, for a total value of $124,890.00. Following the sale, the insider now directly owns 19,569 shares in the company, valued at $2,443,972.41. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which is accessible through this link. In other Merck & Co., Inc. news, EVP Steven Mizell sold 50,694 shares of the firm's stock in a transaction dated Friday, February 2nd. The shares were sold at an average price of $126.65, for a total transaction of $6,420,395.10. Following the transaction, the executive vice president now owns 23,619 shares of the company's stock, valued at approximately $2,991,346.35. The transaction was disclosed in a filing with the SEC, which can be accessed through this link. Also, insider Joseph Romanelli sold 1,000 shares of the company's stock in a transaction that occurred on Tuesday, February 13th. The stock was sold at an average price of $124.89, for a total transaction of $124,890.00. Following the completion of the sale, the insider now directly owns 19,569 shares of the company's stock, valued at $2,443,972.41. The disclosure for this sale can be found here. Company insiders own 0.09% of the company's stock.

Merck & Co., Inc. Stock Up 0.4 %

NYSE:MRK traded up $0.47 during mid-day trading on Friday, reaching $131.19. The stock had a trading volume of 7,757,292 shares, compared to its average volume of 8,336,532. The company has a debt-to-equity ratio of 0.89, a current ratio of 1.25 and a quick ratio of 1.00. The company has a market capitalization of $332.31 billion, a price-to-earnings ratio of 937.07, a price-to-earnings-growth ratio of 1.65 and a beta of 0.38. Merck & Co., Inc. has a 1-year low of $99.14 and a 1-year high of $133.10. The stock's 50 day simple moving average is $126.41 and its two-hundred day simple moving average is $115.88.

Merck & Co., Inc. (NYSE:MRK - Get Free Report) last released its quarterly earnings data on Thursday, April 25th. The company reported $2.07 EPS for the quarter, topping analysts' consensus estimates of $1.94 by $0.13. Merck & Co., Inc. had a net margin of 0.61% and a return on equity of 9.33%. The firm had revenue of $15.78 billion during the quarter, compared to the consensus estimate of $15.21 billion. During the same quarter in the previous year, the company posted $1.40 earnings per share. The firm's revenue was up 8.9% on a year-over-year basis. Equities analysts anticipate that Merck & Co., Inc. will post 8.57 EPS for the current year.

Analyst Ratings Changes

MRK has been the subject of several analyst reports. Truist Financial upped their price objective on Merck & Co., Inc. from $142.00 to $143.00 and gave the company a "buy" rating in a research note on Friday. Societe Generale downgraded shares of Merck & Co., Inc. from a "hold" rating to a "sell" rating and set a $104.00 price objective for the company. in a research report on Monday, March 11th. UBS Group boosted their target price on Merck & Co., Inc. from $135.00 to $148.00 and gave the stock a "buy" rating in a research report on Friday, February 2nd. TD Cowen raised Merck & Co., Inc. from a "market perform" rating to an "outperform" rating and raised their price target for the company from $125.00 to $135.00 in a report on Thursday, January 4th. Finally, Wells Fargo & Company upped their price objective on Merck & Co., Inc. from $130.00 to $135.00 and gave the stock an "equal weight" rating in a report on Wednesday, March 27th. One investment analyst has rated the stock with a sell rating, three have given a hold rating, eight have given a buy rating and one has issued a strong buy rating to the company. According to data from MarketBeat, Merck & Co., Inc. has a consensus rating of "Moderate Buy" and a consensus price target of $131.33.

Check Out Our Latest Stock Analysis on Merck & Co., Inc.

Merck & Co., Inc. Profile

(

Free Report)

Merck & Co, Inc operates as a healthcare company worldwide. It operates through two segments, Pharmaceutical and Animal Health. The Pharmaceutical segment offers human health pharmaceutical products in the areas of oncology, hospital acute care, immunology, neuroscience, virology, cardiovascular, and diabetes under the Keytruda, Bridion, Adempas, Lagevrio, Belsomra, Simponi, and Januvia brands, as well as vaccine products consisting of preventive pediatric, adolescent, and adult vaccines under the Gardasil/Gardasil 9, ProQuad, M-M-R II, Varivax, RotaTeq, Live Oral, Vaxneuvance, Pneumovax 23, and Vaqta names.

Featured Articles

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Merck & Co., Inc., you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Merck & Co., Inc. wasn't on the list.

While Merck & Co., Inc. currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's guide to pot stock investing and which pot companies show the most promise.

Get This Free Report