Hollow Brook Wealth Management LLC trimmed its stake in shares of Planet Fitness, Inc. (NYSE:PLNT - Free Report) by 59.2% during the fourth quarter, according to its most recent filing with the Securities and Exchange Commission. The firm owned 22,459 shares of the company's stock after selling 32,623 shares during the quarter. Hollow Brook Wealth Management LLC's holdings in Planet Fitness were worth $1,640,000 as of its most recent filing with the Securities and Exchange Commission.

Hollow Brook Wealth Management LLC trimmed its stake in shares of Planet Fitness, Inc. (NYSE:PLNT - Free Report) by 59.2% during the fourth quarter, according to its most recent filing with the Securities and Exchange Commission. The firm owned 22,459 shares of the company's stock after selling 32,623 shares during the quarter. Hollow Brook Wealth Management LLC's holdings in Planet Fitness were worth $1,640,000 as of its most recent filing with the Securities and Exchange Commission.

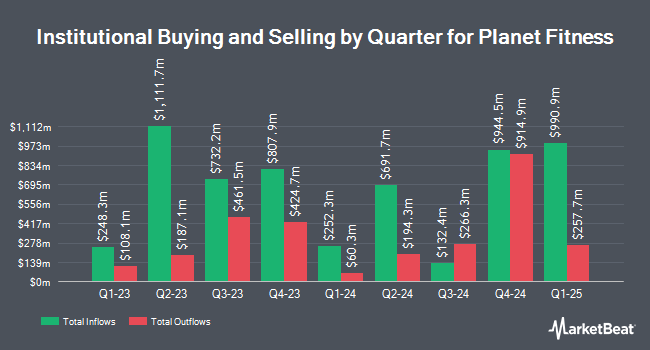

A number of other institutional investors and hedge funds have also made changes to their positions in the stock. Cadian Capital Management LP grew its holdings in Planet Fitness by 164.7% in the 3rd quarter. Cadian Capital Management LP now owns 4,043,507 shares of the company's stock worth $198,860,000 after buying an additional 2,516,007 shares in the last quarter. Bank of New York Mellon Corp lifted its position in shares of Planet Fitness by 0.5% in the third quarter. Bank of New York Mellon Corp now owns 2,659,856 shares of the company's stock worth $130,812,000 after buying an additional 12,139 shares during the last quarter. Bamco Inc. NY increased its stake in shares of Planet Fitness by 20.0% in the third quarter. Bamco Inc. NY now owns 1,200,000 shares of the company's stock worth $59,016,000 after purchasing an additional 200,000 shares during the period. American Century Companies Inc. increased its stake in Planet Fitness by 66.8% during the third quarter. American Century Companies Inc. now owns 877,723 shares of the company's stock valued at $43,166,000 after acquiring an additional 351,401 shares during the period. Finally, Charles Schwab Investment Management Inc. boosted its holdings in Planet Fitness by 3.6% during the third quarter. Charles Schwab Investment Management Inc. now owns 851,951 shares of the company's stock valued at $41,899,000 after purchasing an additional 29,512 shares in the last quarter. 95.53% of the stock is currently owned by institutional investors and hedge funds.

Planet Fitness Stock Performance

Shares of PLNT stock traded down $0.23 during trading hours on Tuesday, reaching $59.84. The company had a trading volume of 2,102,568 shares, compared to its average volume of 1,671,674. The business has a fifty day moving average price of $61.89 and a 200-day moving average price of $64.95. Planet Fitness, Inc. has a one year low of $44.13 and a one year high of $84.48. The firm has a market cap of $5.28 billion, a PE ratio of 36.93, a price-to-earnings-growth ratio of 1.96 and a beta of 1.39.

Planet Fitness (NYSE:PLNT - Get Free Report) last announced its quarterly earnings results on Thursday, February 22nd. The company reported $0.60 EPS for the quarter, topping analysts' consensus estimates of $0.58 by $0.02. The firm had revenue of $285.10 million during the quarter, compared to analyst estimates of $282.35 million. Planet Fitness had a net margin of 12.91% and a negative return on equity of 120.89%. The business's revenue for the quarter was up 1.4% on a year-over-year basis. During the same period in the previous year, the business posted $0.53 earnings per share. Equities research analysts forecast that Planet Fitness, Inc. will post 2.48 EPS for the current year.

Wall Street Analyst Weigh In

A number of analysts recently commented on PLNT shares. Royal Bank of Canada upped their price objective on shares of Planet Fitness from $74.00 to $80.00 and gave the company an "outperform" rating in a research report on Tuesday, March 5th. JPMorgan Chase & Co. cut their price target on shares of Planet Fitness from $75.00 to $72.00 and set a "neutral" rating on the stock in a report on Monday, February 26th. Piper Sandler lifted their price target on shares of Planet Fitness from $88.00 to $89.00 and gave the company an "overweight" rating in a research note on Thursday, January 11th. Stifel Nicolaus cut their price target on shares of Planet Fitness from $85.00 to $80.00 and set a "buy" rating on the stock in a report on Friday, February 23rd. Finally, StockNews.com upgraded shares of Planet Fitness from a "sell" rating to a "hold" rating in a research note on Wednesday, April 10th. Six equities research analysts have rated the stock with a hold rating, eight have assigned a buy rating and one has issued a strong buy rating to the company. According to MarketBeat, the stock currently has an average rating of "Moderate Buy" and a consensus price target of $71.00.

Read Our Latest Analysis on PLNT

Planet Fitness Company Profile

(

Free Report)

Planet Fitness, Inc, together with its subsidiaries, franchises and operates fitness centers under the Planet Fitness brand. The company operates through three segments: Franchise, Corporate-Owned Stores, and Equipment. The company is involved in franchising business in the United States, Puerto Rico, Canada, Panama, Mexico, and Australia.

Further Reading

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Planet Fitness, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Planet Fitness wasn't on the list.

While Planet Fitness currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

Get This Free Report