Guardian Capital LP raised its position in TELUS Co. (NYSE:TU - Free Report) TSE: T by 20.3% during the 4th quarter, according to the company in its most recent Form 13F filing with the Securities and Exchange Commission (SEC). The firm owned 4,291,494 shares of the Wireless communications provider's stock after buying an additional 723,867 shares during the quarter. TELUS comprises about 2.8% of Guardian Capital LP's holdings, making the stock its 12th largest position. Guardian Capital LP owned about 0.29% of TELUS worth $76,743,000 at the end of the most recent reporting period.

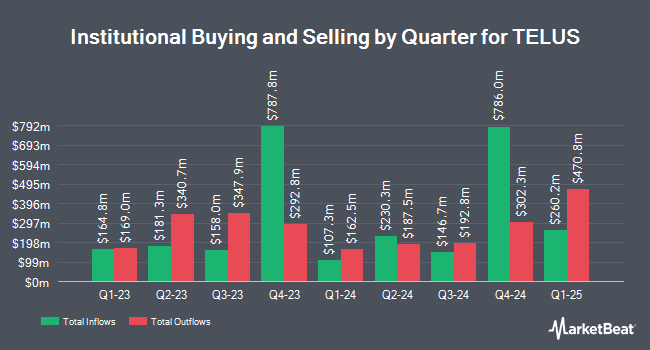

Several other institutional investors and hedge funds also recently made changes to their positions in the company. Quadrature Capital Ltd bought a new stake in shares of TELUS during the 3rd quarter valued at $28,436,000. Scotia Capital Inc. lifted its holdings in shares of TELUS by 10.2% in the third quarter. Scotia Capital Inc. now owns 16,675,010 shares of the Wireless communications provider's stock worth $272,179,000 after buying an additional 1,542,942 shares in the last quarter. Invesco Ltd. boosted its position in shares of TELUS by 14.1% in the third quarter. Invesco Ltd. now owns 11,374,743 shares of the Wireless communications provider's stock valued at $185,863,000 after acquiring an additional 1,409,188 shares during the period. Toronto Dominion Bank grew its stake in TELUS by 7.6% during the third quarter. Toronto Dominion Bank now owns 15,971,196 shares of the Wireless communications provider's stock valued at $260,969,000 after acquiring an additional 1,126,322 shares in the last quarter. Finally, AEGON ASSET MANAGEMENT UK Plc bought a new stake in TELUS during the 4th quarter worth approximately $19,989,000. Institutional investors own 49.40% of the company's stock.

TELUS Stock Up 1.0 %

Shares of NYSE:TU traded up $0.17 during midday trading on Tuesday, reaching $16.44. The company's stock had a trading volume of 1,477,202 shares, compared to its average volume of 2,458,294. TELUS Co. has a 12-month low of $15.35 and a 12-month high of $20.67. The firm has a market capitalization of $24.27 billion, a P/E ratio of 42.08, a PEG ratio of 1.97 and a beta of 0.71. The firm has a 50 day moving average of $16.30 and a 200-day moving average of $17.25. The company has a quick ratio of 0.70, a current ratio of 0.75 and a debt-to-equity ratio of 1.42.

TELUS Increases Dividend

The business also recently declared a quarterly dividend, which will be paid on Tuesday, July 2nd. Stockholders of record on Monday, June 10th will be issued a dividend of $0.282 per share. The ex-dividend date of this dividend is Monday, June 10th. This is an increase from TELUS's previous quarterly dividend of $0.28. This represents a $1.13 annualized dividend and a dividend yield of 6.86%. TELUS's dividend payout ratio (DPR) is presently 284.62%.

Analysts Set New Price Targets

Several brokerages have recently commented on TU. StockNews.com lowered TELUS from a "hold" rating to a "sell" rating in a report on Tuesday, March 26th. Scotiabank restated a "sector perform" rating and set a $26.00 price objective (down previously from $28.00) on shares of TELUS in a research report on Monday, March 25th. Finally, BMO Capital Markets cut their target price on shares of TELUS from $27.00 to $26.00 and set an "outperform" rating for the company in a research report on Monday, February 12th. One analyst has rated the stock with a sell rating, three have issued a hold rating and one has assigned a buy rating to the company's stock. Based on data from MarketBeat.com, TELUS presently has a consensus rating of "Hold" and an average price target of $27.72.

Read Our Latest Research Report on TU

About TELUS

(

Free Report)

TELUS Corporation, together with its subsidiaries, provides a range of telecommunications and information technology products and services in Canada. It operates through Technology Solutions and Digitally-Led Customer Experiences segments. The Technology Solutions segment offers a range of telecommunications products and services; network services; healthcare services; mobile technologies equipment; data services, such as internet protocol; television; hosting, managed information technology, and cloud-based services; software, data management, and data analytics-driven smart food-chain and consumer goods technologies; home and business security; healthcare software and technology solutions; and voice and other telecommunications services, as well as mobile and fixed voice and data telecommunications services and products.

Featured Articles

Want to see what other hedge funds are holding TU? Visit HoldingsChannel.com to get the latest 13F filings and insider trades for TELUS Co. (NYSE:TU - Free Report) TSE: T.

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider TELUS, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and TELUS wasn't on the list.

While TELUS currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are likely to thrive in today's challenging market? Click the link below and we'll send you MarketBeat's list of ten stocks that will drive in any economic environment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.