Kestrel Investment Management Corp cut its stake in shares of Vista Outdoor Inc. (NYSE:VSTO - Free Report) by 16.1% in the fourth quarter, according to the company in its most recent disclosure with the SEC. The firm owned 162,550 shares of the company's stock after selling 31,100 shares during the quarter. Vista Outdoor makes up 3.3% of Kestrel Investment Management Corp's portfolio, making the stock its 12th largest holding. Kestrel Investment Management Corp owned about 0.28% of Vista Outdoor worth $4,807,000 as of its most recent filing with the SEC.

Kestrel Investment Management Corp cut its stake in shares of Vista Outdoor Inc. (NYSE:VSTO - Free Report) by 16.1% in the fourth quarter, according to the company in its most recent disclosure with the SEC. The firm owned 162,550 shares of the company's stock after selling 31,100 shares during the quarter. Vista Outdoor makes up 3.3% of Kestrel Investment Management Corp's portfolio, making the stock its 12th largest holding. Kestrel Investment Management Corp owned about 0.28% of Vista Outdoor worth $4,807,000 as of its most recent filing with the SEC.

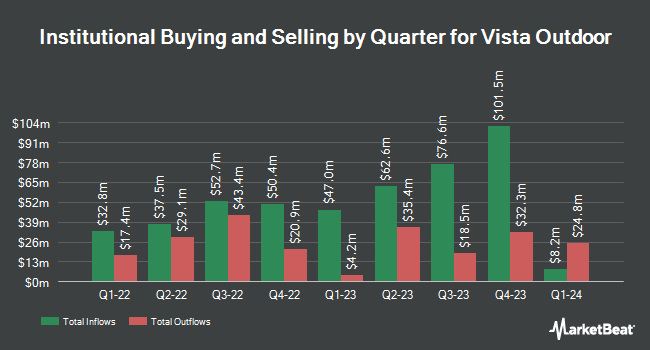

Other hedge funds and other institutional investors also recently made changes to their positions in the company. Quarry LP bought a new position in shares of Vista Outdoor during the second quarter valued at $26,000. Fifth Third Bancorp raised its holdings in shares of Vista Outdoor by 208.6% in the third quarter. Fifth Third Bancorp now owns 969 shares of the company's stock valued at $32,000 after buying an additional 655 shares during the last quarter. CWM LLC raised its holdings in shares of Vista Outdoor by 68.4% in the third quarter. CWM LLC now owns 997 shares of the company's stock valued at $33,000 after buying an additional 405 shares during the last quarter. Ancora Advisors LLC raised its holdings in shares of Vista Outdoor by 162.5% in the third quarter. Ancora Advisors LLC now owns 1,575 shares of the company's stock valued at $52,000 after buying an additional 975 shares during the last quarter. Finally, Tower Research Capital LLC TRC raised its holdings in shares of Vista Outdoor by 794.0% in the first quarter. Tower Research Capital LLC TRC now owns 1,949 shares of the company's stock valued at $54,000 after buying an additional 1,731 shares during the last quarter. 90.51% of the stock is owned by institutional investors.

Vista Outdoor Trading Up 0.6 %

VSTO stock traded up $0.19 during midday trading on Friday, reaching $32.36. The stock had a trading volume of 502,243 shares, compared to its average volume of 515,585. The business has a fifty day simple moving average of $31.89 and a two-hundred day simple moving average of $29.31. The company has a quick ratio of 1.09, a current ratio of 2.58 and a debt-to-equity ratio of 0.71. The firm has a market cap of $1.88 billion, a price-to-earnings ratio of -5.41 and a beta of 0.96. Vista Outdoor Inc. has a twelve month low of $23.33 and a twelve month high of $33.96.

Vista Outdoor (NYSE:VSTO - Get Free Report) last announced its quarterly earnings data on Wednesday, January 31st. The company reported $0.80 EPS for the quarter, missing analysts' consensus estimates of $0.84 by ($0.04). The firm had revenue of $682.25 million during the quarter, compared to analyst estimates of $687.85 million. Vista Outdoor had a positive return on equity of 20.00% and a negative net margin of 12.17%. As a group, research analysts expect that Vista Outdoor Inc. will post 3.87 EPS for the current fiscal year.

Wall Street Analysts Forecast Growth

A number of research firms recently issued reports on VSTO. Monness Crespi & Hardt lifted their price target on Vista Outdoor from $34.00 to $37.00 and gave the company a "buy" rating in a report on Friday, February 2nd. StockNews.com began coverage on Vista Outdoor in a report on Saturday, April 13th. They issued a "buy" rating for the company. Roth Capital raised Vista Outdoor from a "neutral" rating to a "buy" rating in a report on Thursday, April 4th. Finally, Roth Mkm raised Vista Outdoor from a "neutral" rating to a "buy" rating and lifted their price target for the company from $31.00 to $38.00 in a report on Thursday, April 4th. Six investment analysts have rated the stock with a buy rating, Based on data from MarketBeat, the company currently has a consensus rating of "Buy" and an average target price of $34.67.

Read Our Latest Research Report on Vista Outdoor

About Vista Outdoor

(

Free Report)

Vista Outdoor Inc designs, manufactures, and markets outdoor recreation and shooting sports products. in the United States and internationally. The company operates through two segments, Sporting Products and Outdoor Products. The Sporting Products segment designs, develops, manufactures, and distributes ammunitions, components, and related equipment and accessories for hunters, recreational shooters, federal and local law enforcement agencies, and military.

Featured Articles

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Vista Outdoor, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Vista Outdoor wasn't on the list.

While Vista Outdoor currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering when you'll finally be able to invest in SpaceX, StarLink, or The Boring Company? Click the link below to learn when Elon Musk will let these companies finally IPO.

Get This Free Report