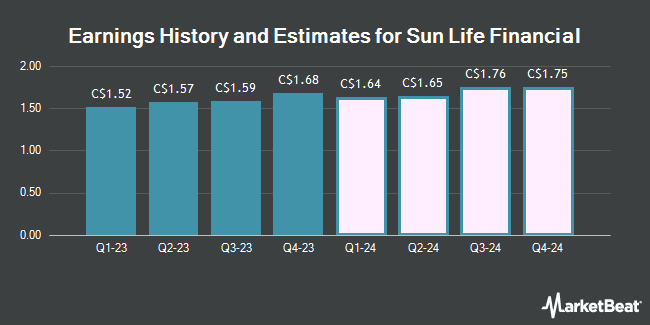

Sun Life Financial Inc. (TSE:SLF - Free Report) NYSE: SLF - Investment analysts at Cormark raised their Q1 2024 earnings per share estimates for shares of Sun Life Financial in a research note issued on Thursday, April 25th. Cormark analyst L. Persaud now anticipates that the financial services provider will post earnings of $1.63 per share for the quarter, up from their prior estimate of $1.61. The consensus estimate for Sun Life Financial's current full-year earnings is $6.90 per share.

Other equities analysts have also issued reports about the company. BMO Capital Markets boosted their price target on Sun Life Financial from C$70.00 to C$80.00 and gave the stock an "outperform" rating in a research report on Thursday, January 25th. Royal Bank of Canada boosted their price target on Sun Life Financial from C$76.00 to C$77.00 and gave the stock an "outperform" rating in a research report on Friday, February 9th. TD Securities boosted their price target on Sun Life Financial from C$73.00 to C$75.00 and gave the stock a "hold" rating in a research report on Friday, April 12th. Scotiabank boosted their price target on Sun Life Financial from C$75.00 to C$76.00 in a research report on Tuesday, February 6th. Finally, National Bankshares boosted their price target on Sun Life Financial from C$72.00 to C$73.00 and gave the stock a "sector perform" rating in a research report on Friday. Two analysts have rated the stock with a hold rating and six have given a buy rating to the company's stock. According to MarketBeat, the stock currently has a consensus rating of "Moderate Buy" and an average price target of C$76.91.

Check Out Our Latest Stock Report on SLF

Sun Life Financial Trading Up 0.8 %

Shares of TSE:SLF traded up C$0.53 during trading on Friday, reaching C$70.67. 881,265 shares of the stock were exchanged, compared to its average volume of 1,817,403. The company has a debt-to-equity ratio of 78.47, a quick ratio of 84,866.00 and a current ratio of 6.81. Sun Life Financial has a 12-month low of C$61.84 and a 12-month high of C$74.94. The firm has a market cap of C$41.16 billion, a price-to-earnings ratio of 13.44, a price-to-earnings-growth ratio of 1.25 and a beta of 0.96. The firm's 50-day moving average price is C$72.60 and its 200 day moving average price is C$69.60.

Sun Life Financial (TSE:SLF - Get Free Report) NYSE: SLF last issued its earnings results on Wednesday, February 7th. The financial services provider reported C$1.68 earnings per share (EPS) for the quarter, topping analysts' consensus estimates of C$1.59 by C$0.09. Sun Life Financial had a return on equity of 13.98% and a net margin of 10.26%. The business had revenue of C$18.68 billion during the quarter.

Sun Life Financial Increases Dividend

The firm also recently announced a quarterly dividend, which was paid on Thursday, March 28th. Shareholders of record on Wednesday, February 28th were given a $0.78 dividend. This represents a $3.12 dividend on an annualized basis and a dividend yield of 4.41%. This is a positive change from Sun Life Financial's previous quarterly dividend of $0.75. The ex-dividend date was Tuesday, February 27th. Sun Life Financial's dividend payout ratio is presently 59.32%.

Insider Buying and Selling at Sun Life Financial

In other Sun Life Financial news, Senior Officer Daniel Fishbein sold 16,000 shares of the company's stock in a transaction that occurred on Monday, February 26th. The stock was sold at an average price of C$74.45, for a total value of C$1,191,120.00. 0.03% of the stock is currently owned by corporate insiders.

About Sun Life Financial

(

Get Free Report)

Sun Life Financial Inc, a financial services company, provides savings, retirement, and pension products worldwide. The company operates in five segments: Asset Management, Canada, U.S., Asia, and Corporate. It offers various insurance products, such as term and permanent life; personal health, which includes prescription drugs, dental, and vision care; critical illness; long-term care; and disability, as well as reinsurance.

Recommended Stories

Before you consider Sun Life Financial, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Sun Life Financial wasn't on the list.

While Sun Life Financial currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

Get This Free Report