Private Management Group Inc. cut its position in Arcos Dorados Holdings Inc. (NYSE:ARCO - Free Report) by 5.6% during the 4th quarter, according to the company in its most recent filing with the Securities & Exchange Commission. The fund owned 2,104,990 shares of the restaurant operator's stock after selling 125,869 shares during the quarter. Private Management Group Inc. owned about 1.00% of Arcos Dorados worth $26,712,000 at the end of the most recent quarter.

Private Management Group Inc. cut its position in Arcos Dorados Holdings Inc. (NYSE:ARCO - Free Report) by 5.6% during the 4th quarter, according to the company in its most recent filing with the Securities & Exchange Commission. The fund owned 2,104,990 shares of the restaurant operator's stock after selling 125,869 shares during the quarter. Private Management Group Inc. owned about 1.00% of Arcos Dorados worth $26,712,000 at the end of the most recent quarter.

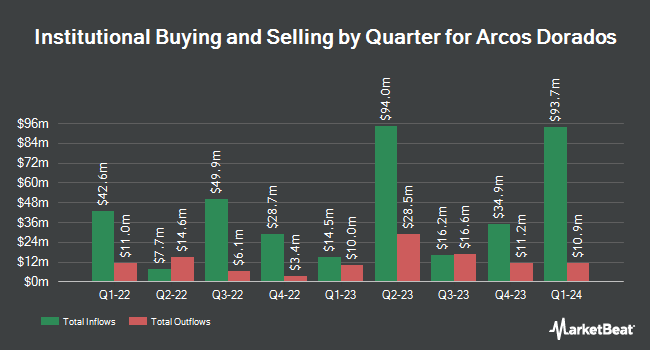

A number of other hedge funds and other institutional investors have also recently bought and sold shares of ARCO. Itau Unibanco Holding S.A. raised its stake in shares of Arcos Dorados by 81.2% during the third quarter. Itau Unibanco Holding S.A. now owns 681,834 shares of the restaurant operator's stock valued at $6,450,000 after purchasing an additional 305,588 shares in the last quarter. Healthcare of Ontario Pension Plan Trust Fund acquired a new position in Arcos Dorados in the third quarter worth approximately $2,838,000. Sapient Capital LLC bought a new position in shares of Arcos Dorados in the fourth quarter valued at $3,513,000. Redwood Investments LLC lifted its position in shares of Arcos Dorados by 82.5% during the 4th quarter. Redwood Investments LLC now owns 491,647 shares of the restaurant operator's stock valued at $6,239,000 after acquiring an additional 222,295 shares during the last quarter. Finally, Qube Research & Technologies Ltd boosted its stake in shares of Arcos Dorados by 46.1% during the 3rd quarter. Qube Research & Technologies Ltd now owns 537,724 shares of the restaurant operator's stock worth $5,087,000 after acquiring an additional 169,590 shares in the last quarter. 55.91% of the stock is owned by institutional investors and hedge funds.

Wall Street Analysts Forecast Growth

Separately, StockNews.com lowered Arcos Dorados from a "buy" rating to a "hold" rating in a research report on Thursday, April 4th. One research analyst has rated the stock with a hold rating and three have assigned a buy rating to the company. According to data from MarketBeat, Arcos Dorados currently has a consensus rating of "Moderate Buy" and an average target price of $13.38.

View Our Latest Stock Analysis on ARCO

Arcos Dorados Trading Up 1.7 %

Shares of NYSE:ARCO traded up $0.19 during mid-day trading on Tuesday, hitting $11.15. The stock had a trading volume of 777,783 shares, compared to its average volume of 1,090,897. Arcos Dorados Holdings Inc. has a 12-month low of $7.78 and a 12-month high of $13.20. The company has a debt-to-equity ratio of 1.38, a quick ratio of 0.66 and a current ratio of 0.72. The company has a market cap of $2.35 billion, a PE ratio of 13.12, a P/E/G ratio of 0.91 and a beta of 1.26. The company's 50 day moving average is $11.33 and its 200-day moving average is $11.33.

Arcos Dorados (NYSE:ARCO - Get Free Report) last issued its earnings results on Wednesday, March 13th. The restaurant operator reported $0.27 EPS for the quarter. Arcos Dorados had a return on equity of 43.72% and a net margin of 4.18%. The business had revenue of $1.16 billion during the quarter. On average, sell-side analysts predict that Arcos Dorados Holdings Inc. will post 0.95 EPS for the current year.

Arcos Dorados Announces Dividend

The firm also recently announced a quarterly dividend, which will be paid on Friday, December 27th. Stockholders of record on Monday, December 23rd will be issued a $0.06 dividend. The ex-dividend date of this dividend is Monday, December 23rd. This represents a $0.24 dividend on an annualized basis and a dividend yield of 2.15%. Arcos Dorados's dividend payout ratio is 28.24%.

About Arcos Dorados

(

Free Report)

Arcos Dorados Holdings Inc operates as a franchisee of McDonald's restaurants. It has the exclusive right to own, operate, and grant franchises of McDonald's restaurants in 20 countries and territories in Latin America and the Caribbean, including Argentina, Aruba, Brazil, Chile, Colombia, Costa Rica, Curacao, Ecuador, French Guiana, Guadeloupe, Martinique, Mexico, Panama, Peru, Puerto Rico, Trinidad and Tobago, Uruguay, the U.S.

Read More

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Arcos Dorados, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Arcos Dorados wasn't on the list.

While Arcos Dorados currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

Get This Free Report