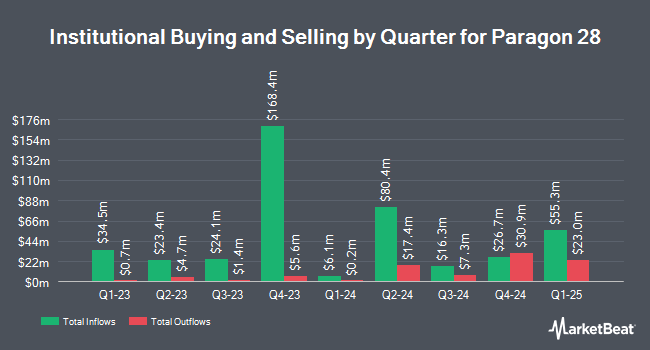

TimesSquare Capital Management LLC cut its stake in Paragon 28, Inc. (NYSE:FNA - Free Report) by 48.0% during the fourth quarter, according to the company in its most recent Form 13F filing with the Securities and Exchange Commission. The fund owned 157,000 shares of the company's stock after selling 145,100 shares during the period. TimesSquare Capital Management LLC owned about 0.19% of Paragon 28 worth $1,952,000 at the end of the most recent quarter.

Other institutional investors also recently added to or reduced their stakes in the company. HighMark Wealth Management LLC purchased a new position in shares of Paragon 28 during the fourth quarter worth approximately $99,000. Zurcher Kantonalbank Zurich Cantonalbank increased its holdings in Paragon 28 by 91.0% during the 3rd quarter. Zurcher Kantonalbank Zurich Cantonalbank now owns 10,984 shares of the company's stock worth $138,000 after purchasing an additional 5,234 shares during the period. Panagora Asset Management Inc. bought a new stake in Paragon 28 during the 3rd quarter valued at $142,000. Jump Financial LLC purchased a new stake in shares of Paragon 28 in the 3rd quarter worth $272,000. Finally, CenterBook Partners LP bought a new position in shares of Paragon 28 during the 3rd quarter worth $319,000. Hedge funds and other institutional investors own 63.57% of the company's stock.

Wall Street Analyst Weigh In

A number of research firms recently weighed in on FNA. JMP Securities lowered their price objective on shares of Paragon 28 from $23.00 to $20.00 and set a "market outperform" rating for the company in a research note on Thursday. Piper Sandler reiterated an "overweight" rating and set a $15.00 price objective (down from $18.00) on shares of Paragon 28 in a research note on Thursday. Needham & Company LLC reduced their price objective on shares of Paragon 28 from $17.00 to $14.00 and set a "buy" rating for the company in a research note on Thursday. Finally, Stephens reiterated an "overweight" rating and issued a $18.00 price target on shares of Paragon 28 in a report on Friday, April 5th. Five research analysts have rated the stock with a buy rating, According to data from MarketBeat.com, the company has a consensus rating of "Buy" and a consensus target price of $16.75.

Check Out Our Latest Report on Paragon 28

Paragon 28 Stock Down 13.2 %

NYSE FNA traded down $1.25 on Thursday, hitting $8.25. The stock had a trading volume of 1,939,520 shares, compared to its average volume of 538,355. Paragon 28, Inc. has a 52-week low of $7.61 and a 52-week high of $19.00. The business's fifty day moving average price is $10.22 and its 200 day moving average price is $11.10. The company has a debt-to-equity ratio of 0.62, a current ratio of 4.21 and a quick ratio of 2.30. The stock has a market cap of $684.01 million, a price-to-earnings ratio of -14.22 and a beta of 1.12.

Paragon 28 (NYSE:FNA - Get Free Report) last issued its quarterly earnings results on Thursday, February 29th. The company reported ($0.19) earnings per share (EPS) for the quarter, missing analysts' consensus estimates of ($0.10) by ($0.09). The company had revenue of $60.56 million for the quarter, compared to analyst estimates of $60.73 million. Paragon 28 had a negative net margin of 22.11% and a negative return on equity of 22.51%. Equities research analysts anticipate that Paragon 28, Inc. will post -0.43 earnings per share for the current year.

Insider Activity at Paragon 28

In other Paragon 28 news, insider Albert Dacosta bought 28,000 shares of the firm's stock in a transaction dated Friday, March 15th. The shares were purchased at an average price of $9.12 per share, for a total transaction of $255,360.00. Following the transaction, the insider now directly owns 5,339,110 shares of the company's stock, valued at approximately $48,692,683.20. The transaction was disclosed in a legal filing with the SEC, which is accessible through this link. 15.32% of the stock is owned by company insiders.

Paragon 28 Company Profile

(

Free Report)

Paragon 28, Inc develops, distributes, and sells foot and ankle surgical systems in the United States and internationally. It offers plating systems, including gorilla plating systems, such as lisfranc, lapidus, lateral column, calcaneus slide, and naviculocuneiform (NC) fusion plating systems; baby gorilla plate-specific screws, navicular fracture plates, and 5th metatarsal hook plates; and silverback plating systems.

Featured Articles

Want to see what other hedge funds are holding FNA? Visit HoldingsChannel.com to get the latest 13F filings and insider trades for Paragon 28, Inc. (NYSE:FNA - Free Report).

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Paragon 28, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Paragon 28 wasn't on the list.

While Paragon 28 currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

If a company's CEO, COO, and CFO were all selling shares of their stock, would you want to know?

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.