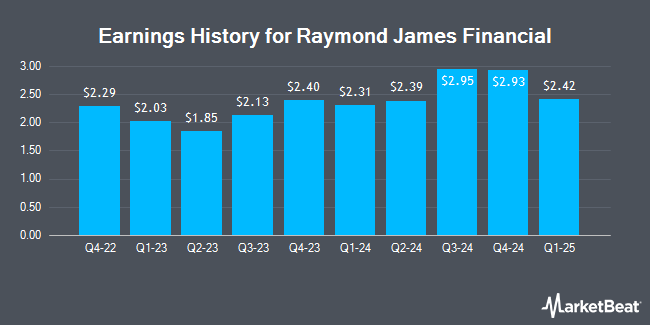

Raymond James (NYSE:RJF - Get Free Report) posted its earnings results on Wednesday. The financial services provider reported $2.31 EPS for the quarter, missing the consensus estimate of $2.32 by ($0.01), Briefing.com reports. The company had revenue of $3.12 billion for the quarter, compared to the consensus estimate of $3.15 billion. Raymond James had a net margin of 12.81% and a return on equity of 17.95%. The firm's revenue for the quarter was up 8.6% compared to the same quarter last year. During the same period last year, the company posted $2.03 earnings per share.

Raymond James (NYSE:RJF - Get Free Report) posted its earnings results on Wednesday. The financial services provider reported $2.31 EPS for the quarter, missing the consensus estimate of $2.32 by ($0.01), Briefing.com reports. The company had revenue of $3.12 billion for the quarter, compared to the consensus estimate of $3.15 billion. Raymond James had a net margin of 12.81% and a return on equity of 17.95%. The firm's revenue for the quarter was up 8.6% compared to the same quarter last year. During the same period last year, the company posted $2.03 earnings per share.

Raymond James Stock Performance

Shares of NYSE RJF opened at $127.54 on Thursday. Raymond James has a 1 year low of $82.00 and a 1 year high of $131.19. The stock has a fifty day moving average price of $122.97 and a two-hundred day moving average price of $112.28. The firm has a market cap of $26.66 billion, a P/E ratio of 15.98, a PEG ratio of 0.89 and a beta of 1.05. The company has a debt-to-equity ratio of 0.37, a quick ratio of 0.97 and a current ratio of 0.99.

Raymond James Announces Dividend

The company also recently declared a quarterly dividend, which was paid on Monday, April 15th. Shareholders of record on Monday, April 1st were paid a dividend of $0.45 per share. This represents a $1.80 dividend on an annualized basis and a yield of 1.41%. The ex-dividend date of this dividend was Thursday, March 28th. Raymond James's payout ratio is currently 22.56%.

Analyst Ratings Changes

Several equities analysts have recently commented on RJF shares. Morgan Stanley upped their target price on Raymond James from $113.00 to $123.00 and gave the company an "equal weight" rating in a report on Tuesday, April 9th. UBS Group decreased their price objective on Raymond James from $116.00 to $115.00 and set a "neutral" rating for the company in a report on Thursday, January 25th. TD Cowen increased their price objective on Raymond James from $116.50 to $131.00 and gave the stock a "market perform" rating in a report on Friday, March 22nd. JMP Securities reissued a "market perform" rating on shares of Raymond James in a report on Tuesday, April 9th. Finally, JPMorgan Chase & Co. raised Raymond James from a "neutral" rating to an "overweight" rating and increased their price objective for the stock from $110.00 to $135.00 in a report on Wednesday, January 10th. Eight research analysts have rated the stock with a hold rating and two have assigned a buy rating to the company's stock. According to MarketBeat, Raymond James currently has a consensus rating of "Hold" and a consensus target price of $123.88.

Check Out Our Latest Report on Raymond James

Insider Activity

In related news, Director Art A. Garcia acquired 879 shares of the business's stock in a transaction dated Friday, February 9th. The stock was bought at an average price of $112.30 per share, for a total transaction of $98,711.70. Following the transaction, the director now owns 879 shares of the company's stock, valued at $98,711.70. The purchase was disclosed in a filing with the SEC, which is available through this hyperlink. In related news, Director Art A. Garcia acquired 879 shares of the business's stock in a transaction dated Friday, February 9th. The stock was bought at an average price of $112.30 per share, for a total transaction of $98,711.70. Following the transaction, the director now owns 879 shares of the company's stock, valued at $98,711.70. The purchase was disclosed in a filing with the SEC, which is available through this hyperlink. Also, EVP Jonathan N. Santelli sold 1,891 shares of the stock in a transaction on Monday, January 29th. The shares were sold at an average price of $111.91, for a total value of $211,621.81. Following the sale, the executive vice president now owns 21,491 shares of the company's stock, valued at approximately $2,405,057.81. The disclosure for this sale can be found here. Insiders own 9.74% of the company's stock.

About Raymond James

(

Get Free Report)

Raymond James Financial, Inc, a financial holding company, through its subsidiaries, engages in the underwriting, distribution, trading, and brokerage of equity and debt securities, and the sale of mutual funds and other investment products in the United States, Canada, Europe, and internationally. The company operates through Private Client Group, Capital Markets, Asset Management, RJ Bank, and Other segments.

Read More

Before you consider Raymond James, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Raymond James wasn't on the list.

While Raymond James currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat has just released its list of 20 stocks that Wall Street analysts hate. These companies may appear to have good fundamentals, but top analysts smell something seriously rotten. Are any of these companies lurking around your portfolio? Find out by clicking the link below.

Get This Free Report