Key Points

- XLF ETF rallied nearly 10% from its June low, creating a favorable risk-reward buying opportunity as it returns to uptrend support.

- XLF focuses on large banks, offering low-cost passive exposure to major players in the US financials segment via a cap-weighted, S&P 500-only portfolio.

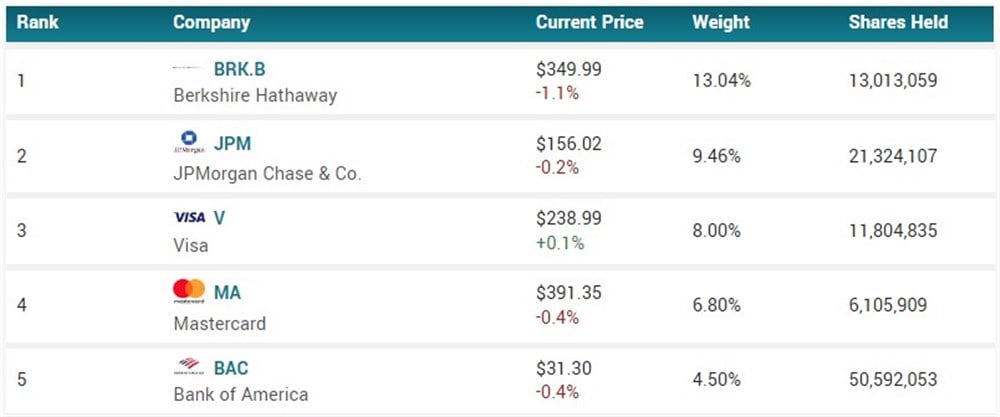

- Top holdings like Berkshire Hathaway, JPMorgan Chase, Visa, Mastercard, and Bank of America significantly impact XLF's performance, necessitating close monitoring by investors.

- 5 stocks we like better than Financial Select Sector SPDR Fund

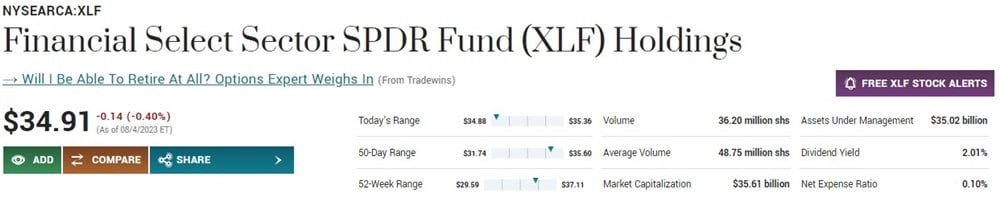

The Financial Select Sector SPDR FUND NYSE: XLF has staged an impressive rally over the past few months, climbing almost 10% from its June low. As the ETF pulls back into its uptrend support, an attractive risk: reward buying opportunity is forming. Although only up 2% year-to-date, if the ETF can find support and confirm a higher low within the uptrend, its performance could drastically increase.

The XLF is an ETF providing exposure to significant players in the US financials segment. It focuses on large banks through a cap-weighted, S&P 500-only portfolio, avoiding small-cap companies. The ETF aims to provide investors with a low-cost passive approach for investing in a portfolio of equity securities of firms as represented by the Financial Select Sector Index.

Geographic, Sector, and Industry Exposure

The XLF predominantly has geographic exposure to the United States, with over 95.2% geographic exposure based on its current holdings. As you’d expect, the sector exposure of the ETF is almost entirely weighted towards the financial sector, with 98% exposure and 1.7% exposure to the technology sector. Within the financial sector, the ETF has 27.4% insurance industry exposure, 24.2% bank industry exposure, 22.1% diversified financial services exposure, and 21.5% capital markets exposure.

Top 5 Holdings

When evaluating a sector-specific ETF for potential investment, it is essential to go beyond simply examining the chart. It becomes crucial to closely monitor the most heavily weighted holdings, as they significantly influence the ETF's overall performance.

Berkshire Hathaway NYSE: BRK.B has outperformed the broader financial sector, with its stock up 13.3% year-to-date. Shares last traded at $349.99, just $10 away from its ATH.

JPMorgan Chase & Co. NYSE: JPM, like BRK.B, has outperformed the financial sector, up 16.35% year-to-date. The stock has a Moderate Buy rating based on eighteen analyst ratings and a consensus price target of $164.39, predicting a 5.36% upside.

Visa NYSE: V shares are trading in a firm uptrend, about $12 away from its ATH. Year-to-date, the stock is up 15.03%, and analysts see a 13.11% upside for the stock based on the consensus analyst price target.

Mastercard NYSE: MA recently broke above a critical resistance level at $400 but failed to hold above. Year-to-date shares are up 12.54%, and analysts, based on nineteen ratings, have the stock as a Moderate Buy.

Bank of America NYSE: BAC is up close to 11% over the last month. However, the stock remains in a higher time frame downtrend. Analysts see a 15.85% upside for the stock, based on the consensus price target of $36.26.

Should You Invest In XLF?

Since its June low, the ETF has impressively reclaimed its key moving averages, like the 200-day SMA, and formed a steady uptrend. While the ETF has pulled back slightly over the past week, it remains above its uptrend, indicating that momentum still favors the bulls.

If the ETF can find support and confirm a higher low above the uptrend, a move towards $35.5 - $36 could be possible in the short term.

Before you consider Financial Select Sector SPDR Fund, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Financial Select Sector SPDR Fund wasn't on the list.

While Financial Select Sector SPDR Fund currently has a "hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Do you expect the global demand for energy to shrink?! If not, it's time to take a look at how energy stocks can play a part in your portfolio.

Get This Free Report