Key Points

- Okta is a leading cybersecurity firm specializing in indent and access management (IAM) solutions that suffered security breaches in the latter part of 2023.

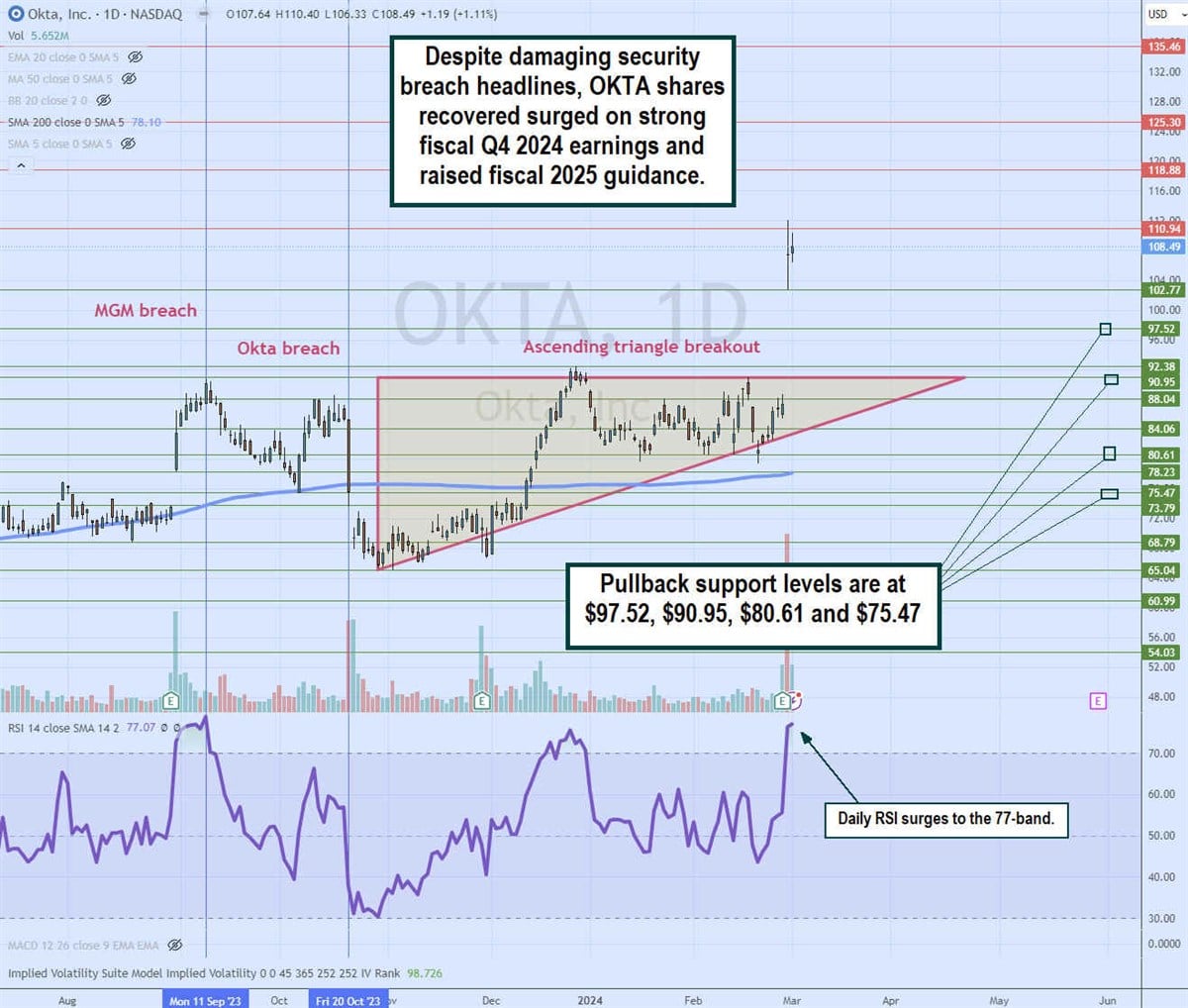

- The negative publicity caused shares to fall to a swing low of $65.04 in October 2023, causing investors to worry about its fiscal Q4 2024 earnings.

- Okta knocks it out of the park with its fiscal Q4 2024 performance and raises fiscal 2025 top and bottom line guidance.

- 5 stocks we like better than Okta

Okta Inc. NASDAQ: OKTA is a cybersecurity company that specializes in identity and access management (IAM) solutions. The computer and technology sector firm helps companies protect against identity-based attacks by providing services aimed at securing employee and customer identities. Some of its tools include multifactor authorizations, single sign-on (SSO) access to multiple applications, access management and user lifecycle management from onboarding to offboarding. Its roster of computer and technology sector clients includes Alphabet Inc. NASDAQ: GOOGL, Amazon.com Inc. NASDAQ: AMZN, Microsoft Co. NASDAQ: MSFT and Oracle Co. NYSE: ORCL.

Okta's Reputation Hit by Customer Security Breaches

In September 2023, hackers were able to breach many of their big-name casino clients, including Caesars Entertainment Inc. NASDAQ: CZR, MGM Resorts International NYSE: MGM and three other companies using social engineering techniques. MGM claimed nearly $100 million in damages from the data breach after refusing to pay ransom to hacker group Scattered Spider. Caesars paid the ransomware to keep its systems operating. These groups use social engineering techniques to target employees by using information acquired through their social media to convince them to provide access unwittingly.

Okta assured the public that their systems were not compromised or breached in these incidents. Its shares sold off from $90.47 to $75.47 in the following weeks. Investors feared an impact on its reputation would impact its operations.

Security Breach Hits Home

Shares managed to recover back to $88.04 when Okta suffered a security data breach in its systems on October 20, 2023. This sent shares plummeting 20% in the following days, reaching a swing low of $65.04 on October 30, 2023. Clearly, it's a bad look when a cybersecurity company gets hacked. Hackers exploited stolen login credentials of an Okta admin's Google account to gain access to Okta's customer support system. Okta claims there's no evidence that hackers exploited information. Investors feared these security breaches could have a financial impact on Okta's performance. Their fears were assuaged when Okta released blowout numbers.

Solid Revenue and Earnings Growth

On February 28, 2024, Okta reported fiscal Q4 2024 EPS of 63 cents, beating consensus analyst expectations by 12 cents. Okta hit record non-GAAP profitability. GAAP operating loss was $83 million or 14% of total revenues compared to $157 million and 31% of total revenue in the year ago period.

Revenues grew 18.6% YoY to $605 million versus $587.2 million consensus estimates. Subscription backlog or remaining performance obligations (RPO) were $3.385 billion, up 13% YoY. Current remaining performance obligations (cRPO) rose 16% YoY to $1.952 billion. Okta had a record operating cash flow (OCF) of $174 million and free cash flow (FCF) of $166 million.

Okta Raises Its Guidance

Okta raised its fiscal Q1 2025 EPS to 54 to 55 cents versus 41 cents consensus analyst estimates. It raised Q1 revenues to $603 million to $605 million versus $583.77 million consensus estimates.

For the fiscal full year 2025, non-GAAP diluted EPS is expected to be between $2.24 and $2.29 versus $1.96, according to consensus analyst estimates. Full year 2025 revenues are expected to grow 10% to 11% YoY to between $2.495 billion to $2.505 billion versus $2.48 billion consensus estimates.

Okta CEO Todd McKinnon commented, "We're also pleased with the strong top-line performance, which was driven by strength with large customers. Organizations continue to turn to Okta to help modernize and simplify their identity infrastructure. As we start the new fiscal year, we're excited to deliver powerful new features and products, with security as the foundation, to serve our customers and power even more identity use cases."

Analyst Actions

Bank of America upgrades OKTA shares to a Buy rating from Underperform with a $135 price target. Analyst Madeline Brooks believes the headwinds of slowing new customer growth, execution issues and saturation among the existing customer base have subsided, as evidenced by RPO and cRPO metrics in fiscal Q4 2024. The guidance looks conservative, with a stronger pipeline heading into fiscal 2025 in tow.

OKTA analyst ratings and price targets are at MarketBeat.Okta's peers and competitor stocks can be found with the MarketBeat stock screener.

Ascending Triangle Breakout

The daily candlestick chart on OKTA illustrates an ascending triangle breakout. The ascending lower trendline formed at $65.18 on October 30, 2024. It formed as pullbacks formed higher lows, eventually rising through the daily 200-period moving average (MA) resistance, which has now become a support at $78.10. The flat-top upper trendline formed at $90.95 as it was a resistance heading into the fiscal Q4 2024 earnings release. OKTA gapped up on its result to the $102.77 level. The daily relative strength index (RSI) surged through the overbought 70-band to peak at the 77-band. Pullback support levels are at $97.52, $90.95, $80.61 and $75.47.

Before you consider Okta, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Okta wasn't on the list.

While Okta currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's guide to pot stock investing and which pot companies show the most promise.

Get This Free Report