Assenagon Asset Management S.A. acquired a new stake in Groupon, Inc. (NASDAQ:GRPN - Free Report) in the 1st quarter, according to the company in its most recent filing with the Securities and Exchange Commission (SEC). The firm acquired 53,296 shares of the coupon company's stock, valued at approximately $711,000. Assenagon Asset Management S.A. owned 0.14% of Groupon as of its most recent SEC filing.

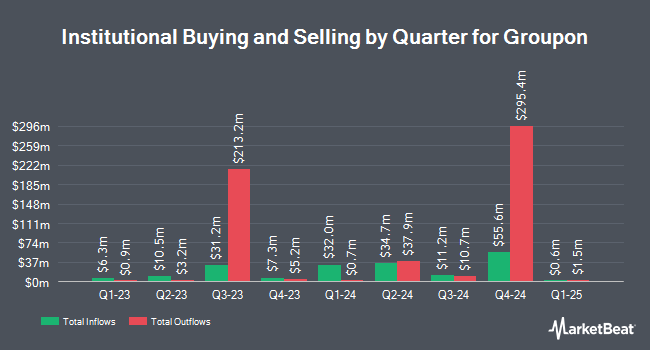

Several other hedge funds and other institutional investors have also recently made changes to their positions in GRPN. Zurcher Kantonalbank Zurich Cantonalbank purchased a new position in Groupon during the 4th quarter valued at about $25,000. SG Americas Securities LLC purchased a new stake in shares of Groupon during the fourth quarter worth about $113,000. Raymond James & Associates purchased a new stake in shares of Groupon during the fourth quarter worth about $202,000. Citigroup Inc. grew its holdings in shares of Groupon by 2,630.5% during the third quarter. Citigroup Inc. now owns 14,881 shares of the coupon company's stock worth $228,000 after buying an additional 14,336 shares in the last quarter. Finally, Kamunting Street Capital Management L.P. purchased a new stake in shares of Groupon during the third quarter worth about $230,000. Institutional investors and hedge funds own 90.05% of the company's stock.

Groupon Trading Down 1.9 %

GRPN stock traded down $0.32 during midday trading on Wednesday, reaching $16.51. 1,111,328 shares of the company's stock traded hands, compared to its average volume of 1,294,277. The company has a market capitalization of $652.81 million, a P/E ratio of -12.80 and a beta of 1.68. The company has a debt-to-equity ratio of 5.48, a current ratio of 0.93 and a quick ratio of 0.93. Groupon, Inc. has a fifty-two week low of $4.18 and a fifty-two week high of $19.56. The business has a 50-day moving average price of $12.64 and a two-hundred day moving average price of $13.34.

Groupon (NASDAQ:GRPN - Get Free Report) last announced its quarterly earnings results on Thursday, May 9th. The coupon company reported $0.01 earnings per share for the quarter, beating analysts' consensus estimates of ($0.18) by $0.19. The business had revenue of $123.08 million for the quarter, compared to analyst estimates of $118.37 million. During the same period last year, the firm earned ($0.70) earnings per share. Equities research analysts forecast that Groupon, Inc. will post -0.31 EPS for the current fiscal year.

Wall Street Analysts Forecast Growth

A number of brokerages have recently commented on GRPN. StockNews.com upgraded shares of Groupon from a "sell" rating to a "hold" rating in a report on Monday, March 18th. Roth Mkm restated a "buy" rating and issued a $28.00 target price on shares of Groupon in a report on Tuesday, April 16th. Two equities research analysts have rated the stock with a sell rating, two have given a hold rating and one has given a buy rating to the company's stock. According to data from MarketBeat, the company currently has an average rating of "Hold" and an average price target of $12.38.

Get Our Latest Research Report on Groupon

About Groupon

(

Free Report)

Groupon, Inc, together with its subsidiaries, operates a marketplace that connects consumers to merchants. It operates in two segments, North America and International. The company sells goods or services on behalf of third-party merchants. It serves customers through its mobile applications and websites.

See Also

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Groupon, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Groupon wasn't on the list.

While Groupon currently has a "Reduce" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Market downturns give many investors pause, and for good reason. Wondering how to offset this risk? Click the link below to learn more about using beta to protect yourself.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.